COMPANY DESCRIPTION

Nu Skin Enterprises, Inc. (NYSE: NUS) is a global direct selling leader in beauty and wellness, delivering personal care, nutrition, and smart device systems. Operating in nearly 50 international markets. NUS operates in the direct selling channel, primarily utilizing person-to-person marketing to promote and sell products, including through the use of social and digital platforms.The Company integrates product innovation, bio-device R&D, and digital platforms through its Rhyz ecosystem. Founded in 1984 in Provo, Utah, Nu Skin built its legacy on natural ingredients, science-backed skincare. It expanded into Canada and Asia in the early 1990s, IPO’d in 1996, and added dietary supplements via its 1998 Pharmanex acquisition. The launch of the ageLOC anti-aging line in 2008 marked a major inflection point—followed by successive connected device launches (LumiSpa iO, WellSpa iO, RenuSpa iO)—cementing its reputation in beautytech.

Company Updates

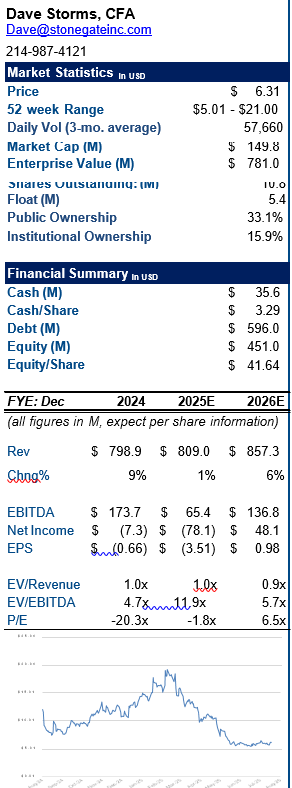

Financial Results: NUS reported revenue, adj Net Income, and adj EPS of

$386.1M, $21.1M, and $0.43, respectively. Revenue was at the high end of

the guidance range, which was $355.0M to $390.0M. Of note was the Rhyz

Manufacturing segment which saw 17% year over year revenue growth. EPS

outpaced guidance by a significant amount, which was in the range of $0.20

to $0.30. Gross margin was 68.8% for the quarter, reflecting a quarter-overquarter expansion of 106 bps from 1Q25. This quarter’s strong performance

was driven by a focus on growing revenue along with operational

optimization efforts leading to the strong year-over-year growth of Adj. Net

Income of 103.5%. We are encouraged by the continued NI margin

expansion as the Company positions itself for a solid 2Q25.

Strategic Initiatives: The Company currently has two strategic initiatives

that are expected to be significant growth drivers in the near to medium term.

Starting with the expansion into India, NUS is on track to begin pre-opening

activities in 4Q25, with a full launch in mid-2026. We expect a steady ramp

up in this new market as the Company goes through the steep learning curve

that comes with entering a new market. With the success seen in Latin

America our expectation is that NUS will apply similar strategies to this new

market. NUS is also on the verge of launching its Prysm iO wellness device.

This AI-powered wellness assessment device will be a game changer for the

Company as its proprietary subscription service will leverage Nu Skin’s

ability to provide personalized product recommendations on a scale that up

until now has been technologically out of reach. We expect that both

initiatives will add further energy into brand reps and sales leaders.

KPIs: Nu Skin ended the quarter with 29,593 sales leaders, 190,799 paid

affiliates, and 771,407 customers. This was a year over year decline of 23%,

16%, and 14%, respectively. Year over year revenue growth was strong in

Latin America at 107% and challenged in South Korea at 22.8%.

Management has noted that the growth in Latin America is in large part due

to the scalable digital first model that has been applied to the region. We

expect this growth will continue.

Balance Sheet and Liquidity: The Company ended the quarter with a

strong balance sheet, having $264.2M in cash on hand and a net cash level

of $15.3M per our calculations. Most importantly the Company generated a

positive net cash position ahead of its schedule, positioning NUS to have

significant flexibility as it executes on the initiatives mentioned above.

Guidance: Following a strong quarter, NUS tightened its FY25 revenue

guidance, to range of $1.48B to $1.55B, up from $1.48B to $1.62B. The

Company also raised its FY25 Adj. EPS guidance to a range of $1.15 to

$1.35, up from $0.90 to $1.30. Next quarter revenues are expected to be in

a range of $360.0M to $390.0M with an EPS range of $0.25 to $035. We

believe NUS is positioned to meet its guidance and have adjusted our model

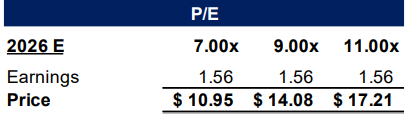

accordingly. Valuation: We use a Price to Adj. EPS comparison when valuing NUS. Currently NUS is trading at a forward Price to Adj. EPS of 5.2x, compared to average comps at 16.9x. We are applying a range of 7.0x to 11.0x with amidpoint of 9.0x when valuing NUS, which returns a per share valuation

range of $10.95 to $17.21, with a midpoint of $14.08.

Business Overview

Nu Skin Enterprises, Inc. (NYSE: NUS) is a global direct-selling leader in beauty and wellness, delivering personal

care, nutrition, and smart device systems. Operating in nearly 50 international markets through a network of

independent Brand Affiliates, the Company integrates product innovation, bio-device R&D, and digital platforms

through its Rhyz ecosystem.

Founded in 1984 in Provo, Utah, Nu Skin built its

legacy on natural ingredients , science-backed

skincare. It expanded into Canada and Asia in the

early 1990s, IPO’d in 1996, and added dietary

supplements via its 1998 Pharmanex acquisition.

The launch of the ageLOC anti-aging line in 2008

marked a major inflection point—followed by successive connected device launches (LumiSpa iO, WellSpa iO, RenuSpa iO)—cementing its reputation in beautytech. NUS operates through three primary brands a beauty brand, Nu Skin; a wellness brand,Pharmanex; and an anti-aging brand, ageLOC.

Exhibit 1: Business Overview

In addition to the core Nu Skin business, the Company also explores new areas of synergistic and adjacent growth through its business arm known as Rhyz Inc. This arm reports through two segments, Manufacturing and Other, which encompass six businesses. In January of 2025, the Company sold Mavely, a business under the Rhyz arm, for ~$250.0M which was ~3.6x FY24 revenues, illustrating the potential that Rhyz Businesses have. Of note, the Company has an extensive history of research and development leading to a constantly evolving product pipeline.

We view this diversification as a net positive, giving NUS a significant reach. Further

information on the nuances of these geographies can be found under the Geographic Overview section.

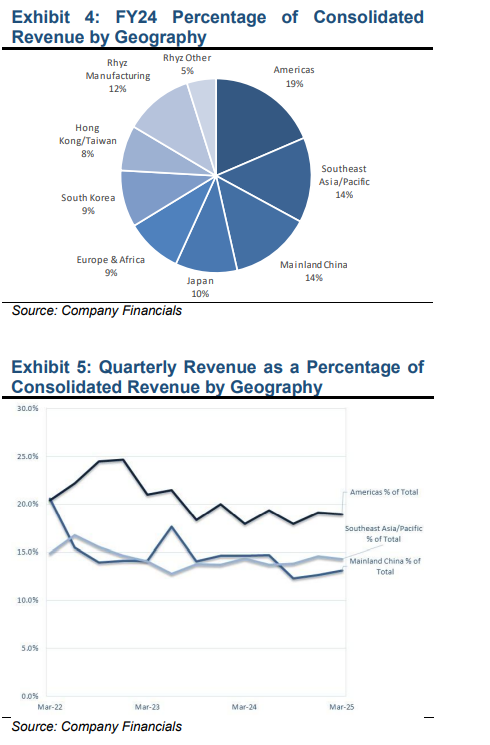

Nu Skin operates in nearly 50 geographies broken into 7 segments at its Core Nu Skin level. With about 19% of Core Nu Skin FY24 revenues generated inthe Americas segment, and an additional 11% of revenue generated in the Rhyz segment, NUS derives ~30% of consolidated revenue from the

western hemisphere. With such a large global footprint, the Company’s international operations are constantly monitored for impacts from currency

and regulation changes.

The Company’s business’s distribution channel is composed of two primary groups: its consumer group, made

up of individuals who buy the Company’s products primarily for personal or family consumption and share products

with friends and family; and its sales network made up of individuals who personally buy, use and resell products,

and who attract new consumers, and recruit, train and develop new sellers. Individuals in the sales network are

classified as either Brand Affiliates or Sales Leaders. Brand Affiliates are individuals who also purchase products

for personal consumption as well as for resale to customers. Brand Affiliates can generate compensation for sales

made to their customers, and are typically under the guidance of a Sales Leader. Sales Leaders are Brand

Affiliates, as well as sales employees and independent marketers in Mainland China, who achieved certain

qualification requirements as of the end of each month of the quarter. These individuals have completed the

qualification process and are actively building a sales network that may be comprised of both Brand Affiliates and

their own customers. With Brand Affiliates working under Sales Leaders the Company is designed in a multi-level

sales structure. This multi-level structure where Sales Leaders can disseminate information efficiently and

personally allows the Company to maintain a person-to-person relationship all the way to end consumers when

new products are introduced.

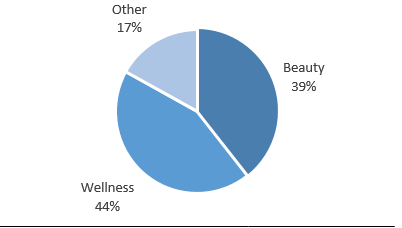

Product Overview

- Beauty Products: Beauty products for NUS fall under the Nu Skin brand. The Company’s strategy for its beauty products category is to leverage its distribution channel to strengthen Nu Skin’s position as an innovative leader in the premium beauty markets. The products in this category include innovative skin care devices, cosmetics, and other personal-care products. Nu Skin is continuously improving and evolving its product-formulations to develop and incorporate innovative and proven-ingredients, with many of the products developed using ingredients that are

scientifically proven to provide visible results.

Wellness Products: Wellness products for NUS fall under

the Pharmanex brand. The Company’s strategy for its wellness category is to continue to introduce innovative,

substantiated nutritional supplements, based on research and development and quality manufacturing. Direct selling has proven to be an effective method of marketing the high-quality wellness products because the sales force can personally educate consumers on the quality and benefits of wellness products, differentiating them from competitors’ offerings.

Rhyz: The Rhyz businesses primarily consist of consumer, technology, and manufacturing companies. In 2024,

the Rhyz companies generated $286.6 million, or 17% of our 2024 reported revenue. Rhyz is a key component of

the business, and these companies enable NUS to reduce the cost of goods, improve lead times, diversify revenue

mix, and create synergies for its owned brands. In January of 2025, NUS sold one of its businesses under the Rhyz

umbrella, showing the ability to monetize portions of this incubator should the opportunity arise.

Sales Channel Overview

Nu Skin maintains a global philosophy of person-to-person marketing believing that the direct selling distribution

is an effective vehicle to distribute products. This is through the rapid outreach to potential customers through the

existing social networks of the Company’s sellers, personalized product demonstrations and offerings, and aftersales servicing from sellers. The Company breaks its sales channel down between its consumer group and its sales network. The consumer group is made up of individuals who buy NUS products primarily for personal or family consumption either through Brand Affiliates or directly from the Company. This group does not have the authority to build a Nu Skin business by reselling products or by recruiting others, and therefore they do not earn any sales compensation.

The sales network is made up of individuals who personally buy, use and resell products, and who also acquire new consumers, and attract, train and develop new sellers. Brand Affiliates both purchase products for personal use as well as for resale to other customers. These individuals are eligible to receive certain compensation under the Company’s global sales compensation plan by selling product to customers and by developing other Brand Affiliates who sell products to consumers, but they are not eligible for other compensation unless they elect to qualify as a Sales Leader. The two ways that Brand Affiliates make money is through retail markups and sales compensation earned under the global sales compensation plan. Importantly there are no requirements to purchase products to become a Brand Affiliate, and no commissions are paid on any purchase of a business portfolio.

Sales Leaders are Brand Affiliates who are qualified and have elected to pursue the business opportunity of

attracting consumers and building a sales network. Where all Brand Affiliates receive compensation for sales to

their own consumer group, Sales Leaders also receive compensation for sales to their own consumer group as

well as sales to other Sales Leaders. There is no requirement to recruit or sponsor other Brand Affiliates, and

there is no compensation for recruiting or sponsoring.

These sales channels are a breakout for Nu Skin’s geographies outside of Mainland China. More information on

how Mainland China differs from the Company’s other geographies can be found in the Geographic Overview

section of this report.

Geographic Overview

As noted above, the Company operates across nearly

50 geographies. NUS breaks out its Core Nu Skin

business into 7 geographic segments, listed below:

- Americas

- Southeast Asia/Pacific

- Mainland China

- Japan

- Europe and Africa

- South Korea

- Hong Kong/Taiwan

In addition to these 7 geographic segments that NUS

uses to characterize its Core Nu Skin business, the

Company also consolidates Rhyz segments into Rhyz

Manufacturing and Rhyz Other. It is noted that the Rhyz

segments are US based. NUS historically generates approximately 20% of its consolidated revenues from the Core Nu Skin Americas segment, making this segment its largest revenue generator.

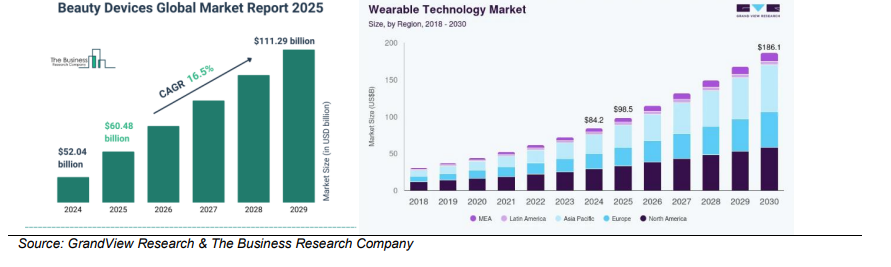

While there are nuances betweenall of the Company’s segments such as product mix and pricing, different engagement tools, and compensation structures, all geographies with the exception of Mainland China tend to operate following similar structures described in the Sales Channel Overview. We are encouraged by the continued geographic diversification that the Company has seen as demonstrated by the top three segments by revenuein Exhibit 5, with no geography accounting for more than 20% of consolidated revenues. Due to restrictions on direct selling and multi-level commissions in Mainland China, the Company has implemented a business model for that market that is different from the business model used in other markets.

In Mainland China, NUS utilizes sales employees to sell products through retail stores, website and

digital platforms; independent direct sellers, who can sell away from stores where the Company has a direct selling

license and a service center and can also sell through the website and digital platform; and independent

marketers, who are licensed business owners authorized to sell products at their own approved premises or

through NUS stores, website and digital platforms. These three types of sellers in the Company’s Mainland China

sales force are also compensated differently from how the Company compensates its sales force in the rest of

the world with Mainland China sales employees receiving both monthly bonuses based on product sales among

other metrics as well as a salary or service fee that is reviewed and adjusted on a quarterly basis based on

performance.

Growth Drivers

Nu Skin Enterprises Inc. is strategically positioned to achieve significant growth through multiple avenues and

market opportunities:

- Strategic Restructuring & Cost Discipline: Nu Skin’s aggressive restructuring efforts in 2024 have

improved operational efficiency, as evidenced by lower general & administrative costs. These measures

restored adjusted EPS to a positive $0.23 in 1Q25, reversing previous losses, and have strengthened

margins despite a revenue decline driven by macroeconomic headwinds. - Expansion in High-Growth and Emerging Markets: The company is tapping into underpenetrated

regions. In 1Q25, Latin America delivered a remarkable 144% year-over-year revenue increase, signaling

success in its developing markets strategy. Management has also identified India as a critical entry point,

with pre-launch activities underway in late 2025 and full operations planned for mid-2026, aiming to

capitalize on one of the world’s fastest-growing direct selling markets. - Product Innovation: Connecting Beauty & Wellness: Nu Skin continues evolving beyond cosmetics.

The upcoming Prysm iO wellness device, slated for later in FY25, is positioned to deepen customer

engagement via nutritional insights and personalized wellness. The recent launch of devices like the

RenuSpa iO microcurrent system and MYND360 cognitive wellness line reflect the firm’s pivot toward

connected beauty-health platforms. - Rhyz Platform: Incubation, M&A and Capital Deployment: Rhyz, Nu Skin’s internal venture arm

launched in 2018, supported by beauty-tech initiatives. While Nu Skin sold its Mavely affiliate-marketing

platform for $250M in early 2025, the sale highlights strategic capital recycling and successful business

incubation. Rhyz’s recent acquisition of BeautyBio enabled expansion into microneedling and hydration

device markets, strengthening Nu Skin’s position in the broader wellness ecosystem. - Balanced Balance Sheet & Capital Return: Nu Skin has methodically reduced debt (now at decade-low

levels), facilitated by disciplined Capex and the Mavely sale. - FX Mitigation & Geographic Diversification: A substantial foreign exchange impact is acknowledged,

yet the diversification across ~50 markets and emphasis on stronger-performing regions like Latin America

and Japan provides natural hedging and opportunity.

Nu Skin’s strategic pivot—combining cost optimization, sharper compensation structures, expansion into highgrowth regions, and an emphasis on wellness-connected devices—offers a robust multi-pronged growth

framework poised to offset near-term headwinds and reaccelerate top-line growth. -

Market Overview

Nu Skin Enterprises operates within the expansive global beauty and wellness industry, leveraging a robust multilevel marketing (MLM) model across diverse geographic regions. Importantly, Nu Skin operates at the nexus of three rapidlygrowing sectors—beauty & personal care products, beauty/wellness devices, and beauty tech. Leadership players span personal care, anti-aging devices, nutritional supplements, and connected wellness platforms.

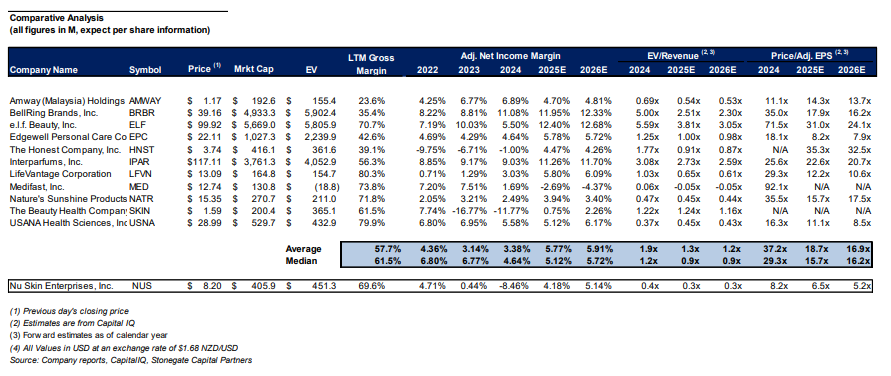

Beauty & Personal Care Products: The global beauty

and personal care market is extremely large and growing – estimated at approximately $519 billion in2024 and projected to reach $550.9 billion in 2025, growing at a CAGR of ~6.1%, and expected to hit ~$700 billion by 2029. Beauty & Wellness Products Market: When including supplements, wellness treatments and services, the broader beauty‑wellness market was valued at around $1.73 trillion in 2024 and is expected to reach $1.86 trillion by 2025, with a strong 8.6% CAGR toward over $3.3 trillion by 2032. Beauty & Skincare Devices: Home beauty devices alone constituted a $52 billion market in 2024, forecasted to grow to $60.5 billion in 2025 (~16% YoY) and doubling to over $111 billion by 2029 at ~16.5% CAGR.

Beauty Tech / Wearables: The beauty tech sector (IoT, app-integrated devices) was estimated at ~$68.9 billion in 2024, projecting to $79.9 billion in 2025 (~16% growth), and reaching ~$131 billion by 2029 (~13% CAGR). Additionally, the broader wearable device market, including wellness wearables—is expected to grow from $84.2 billion in 2024 to $186 billion by 2030 (~13.6% CAGR). These overlapping growth drivers—consumer trends toward personalization, at-home regimes, clean and functional beauty, smart devices, and wellness integration—provide multiple avenues for disruption and platform convergence.

Market Opportunities and Strategic Positioning

Nu Skin is strategically positioned to capitalize on global trends favoring wellness and personalized beauty

technology. The global beauty and wellness device market continues to expand robustly, driven by increasing

consumer health consciousness and demand for at-home beauty solutions. Nu Skin’s upcoming launch of its

Prysm iO intelligent wellness device aligns directly with these market trends, offering personalized health insights

and tailored product recommendations aimed at boosting loyalty and driving subscription revenues.

Additionally, the company’s planned market entry into India, commencing pre-launch activities in late 2025 and a

formal launch scheduled for mid-2026, represents a significant strategic initiative to penetrate a high-potential

emerging market characterized by rapid growth in consumer spending and acceptance of direct-selling models.

Operationally, Nu Skin has strategically prioritized margin improvements through restructuring initiatives and cost

optimization, successfully enhancing operating efficiencies amid challenging market conditions. The sustained

emphasis on affiliate incentives, targeted promotional activities, and digital transformation efforts further

strengthens its competitive positioning and ability to adapt to evolving consumer expectations across diverse

international markets.

We believe that Nu Skin is tapping into multibillion-dollar growth waves such as personal care products expected

to grow to a TAM of $3.3T by 2032 and beauty devices expected to grow to a TAM of $131B by 2029. Its combined

strengths in connected-device innovation, wellness integration, and science-backed personalization, delivered

through a community-driven sales model, position the company to capitalize on long-term consumer trends in

health, self-care, and technology-enabled beauty.

In conclusion, despite short-term challenges stemming from macroeconomic and regulatory pressures in key

markets, Nu Skin’s strategic initiatives focused on product innovation, market diversification, and operational

efficiency position the company favorably to capitalize on emerging global opportunities in the beauty and wellness

sectors. Risks As with any investment, there are certain risks associated with Nu Skin’s operations as well as with the

surrounding economic and regulatory environments common to the personal care products industry.

- Direct selling laws and regulations vary globally, are subject to interpretation or change, and may prohibit

or severely restrict direct selling and cause revenues and profitability to decline. If the business practices

or policies or the actions of the sales force are deemed to be in violation of applicable local regulations,

then the company could be sanctioned which could significantly harm the business. - Compensation for the Company’s sales force could be impacted by regulations such as limits on the

amount of compensation that the Company may provide. This would limit the Company’s ability to attract

and retain its sales force. - The Company operates in markets that are intensely competitive and fast moving. The emergence and

increased adoption of artificial intelligence is a prime example of this. Furthermore, NUS completes with

both large and small direct selling companies, affiliate marketing companies, and employees in the gig

economy, illustrating the breadth of competition. - The Company is subject to financial risks as a result of our international operations, including exposure to

foreign-currency fluctuations, currency controls and inflation in foreign markets, all of which could impact

the Company’s financial position and results of operations. To illustrate this, 70% of FY24 sales occurred

in markets outside of the United States.

VALUATION

We use a Price to Adj. EPS comparison when valuing NUS. Currently NUS is trading at a multiple of 8.2x, which

is a discount of 78% to average comps at 37.2x. While we believe that fair value for comps tends to be closer to

the 15x to 20x range, we also think that this discount is too steep even when accounting for any size or liquidity

adjustments. We note that recent Adj. Net Income margins for NUS have been challenged and may explain a

portion of the discount.

Looking forward we see the Company’s LTM GPM catching up to and exceeding comps, which we view as a

leading indicator for improved performance on the horizon. We expect that the strengthening of the Company’s

balance sheet along with its cost mitigation measures is well timed for the coming expansion into India and the

Prysm iO launch, both of which we expect to be significant tailwinds for the Company in FY26 and beyond. As we

forecast Adj. Net Income margin to catch up to comps we would expect trading multiples to also improve.

Currently NUS is trading at a forward Price to Adj. EPS of 5.2x, compared to average comps at 16.9x. We are

applying a range of 7.0x to 11.0x with a midpoint of 9.0x when valuing NUS, which is in line with the Company’s

historical multiple and also moves NUS closer to comps. We expect to move this multiple range higher as NUS

executes its current strategies, coming more in line with comps. This returns a per share valuation range of $10.95

to $17.21, with a midpoint of $14.08. Lastly, we note that NUS is significantly undervalued on an EV/Revenue basis. While we do not typically use EV/Revenue when valuing companies, it is worth pointing out the significant dislocation seen here. With NUS trading at 0.3x on a forward basis relative to comps at an average of 1.2x on a forward basis we see significant

room for the market to re-rate NUS upwards as the Company executes on and is rewarded for the future growth we expect.

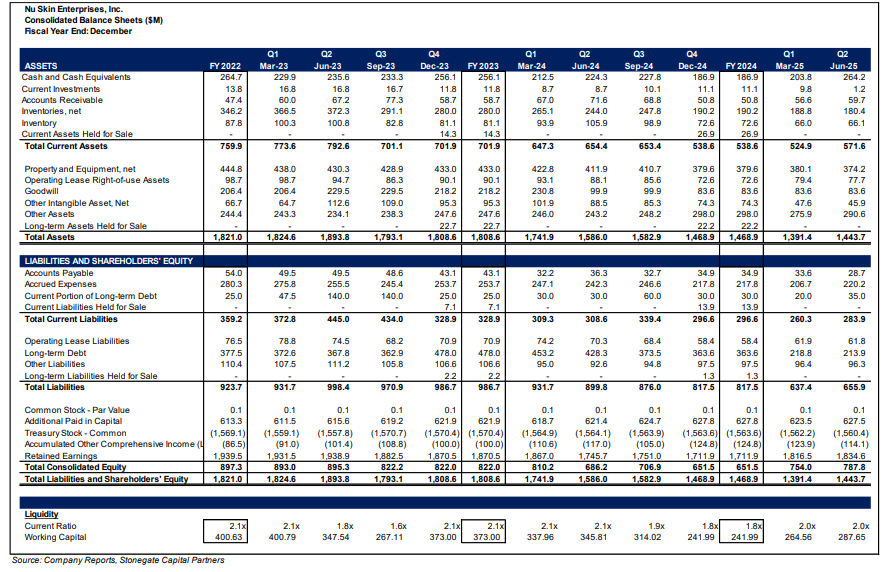

BALANCE SHEET

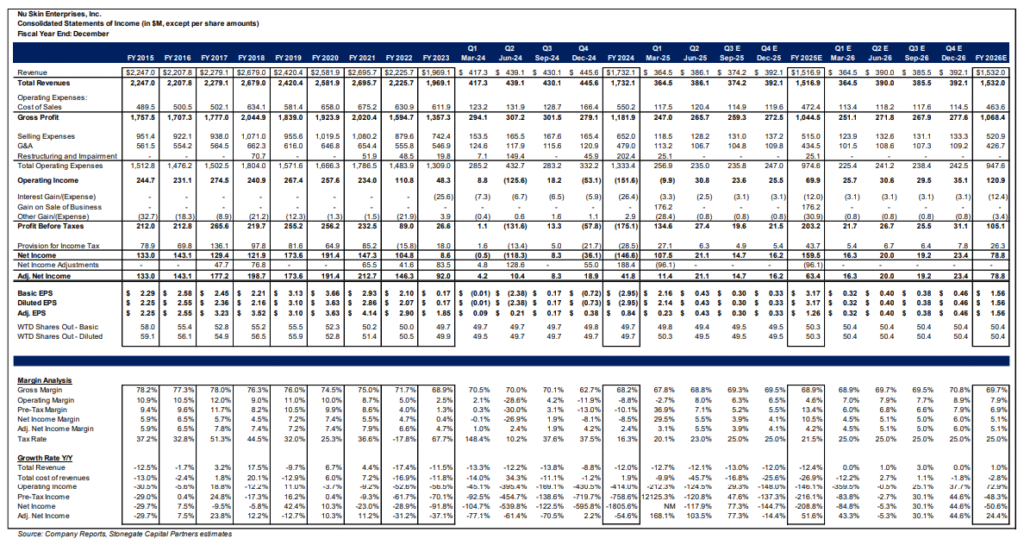

INCOME STATEMENT

IMPORTANT DISCLOSURES AND DISCLAIMER

(a) The research analyst and/or a member of the analyst’s household do not have a financial interest in the debt

or equity securities of the subject company.

(b) The research analyst responsible for the preparation of this report has not received compensation that is based upon Stonegate’s investment banking revenues.

(c) Stonegate or any affiliate have not managed or co-managed a public offering of securities for the subject company in the last twelve months, received investment banking compensation from the subject company in the last 12 months, nor expects or receive or intends or seek compensation for investment banking services from the subject company in the next three months.

(d) Stonegate’s equity affiliate, Stonegate Capital Partners, “SCP” has a contractual agreement with the subject company to provide research services, investor relations support, and investor outreach. SCP receives a monthly retainer for these non-investment banking services.

(e) Stonegate or its affiliates do not beneficially own 1% or more of any class of common equity securities of the subject company.

(f) Stonegate does not make a market in the subject company.

(g) The research analyst has not received any compensation from the subject company in the previous 12 months.

(h) Stonegate, the research analyst, or associated person of Stonegate with the ability to influence the content of

the research report knows or has reason to know of any material conflicts of interest at the time of publication or distribution of the research report.

(i) No employee of Stonegate has a position as an officer or director of the subject company. Ratings – Stonegate does not provide ratings for the covered companies. Distribution of Ratings – Stonegate does not provide ratings for covered companies. Price Chart – Stonegate does not have, nor has previously had, a rating for its covered companies. Price Targets – Stonegate does not provide price targets for its covered companies. However, Stonegate does provide valuation analysis. Regulation Analyst Certification: I, Dave Storms, CFA, hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report.

For Additional Information Contact:

Stonegate Capital Partners, Inc.

Dave Storms, CFA

Dave@stonegateinc.com

214-987-4121

Please note that this report was originally prepared and issued by Stonegate for distribution to their market professional and institutional investor customers. Recipients who are not market professional or institutional investor customers of Stonegate should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. The information contained herein is based on sources which we believe to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. Because the objectives of individual clients may vary, this report is not to be construed as an offer or the solicitation of an offer to sell or buy the securities herein mentioned. This report is the independent work of Stonegate Capital Partners and is not to be construed as having been issued by, or in any way endorsed or guaranteed by, any issuing companies of the securities mentioned herein. The firm and/or its employees and/or its individual shareholders and/or members of their families and/or its managed funds may have positions or warrants in the securities mentioned and, before or after your receipt of this report, may make or recommend purchases and/or sales for their own accounts or for the accounts of other customers of the firm from time to time in the open market or otherwise. While we endeavor to update the information contained herein on a reasonable basis, there may be regulatory, compliance, or other reasons that prevent us from doing so. The opinions or information expressed are believed to be accurate as of the date of this report; no subsequent publication or distribution of this report shall mean or imply that any such opinions or information remains current at any time after the date of this report. All opinions are subject to change without notice, and we do not undertake to advise you of any such changes. Reproduction or redistribution of this report without the expressed written consent of Stonegate Capital Partners is prohibited. Additional information on any securities mentioned is available on request.