OppFi, Inc. is a tech-enabled, mission-driven specialty finance platform that broadens the reach of community banks to extend credit access to everyday Americans. Through its unwavering commitment to customer service, the Company supports consumers who are turned away by mainstream options to build better financial health.

OppFi began trading on the NYSE under the symbol “OPFI” on July 20, 2021, following the completion of a Business Combination Agreement by and among FG New America Acquisition Corp.

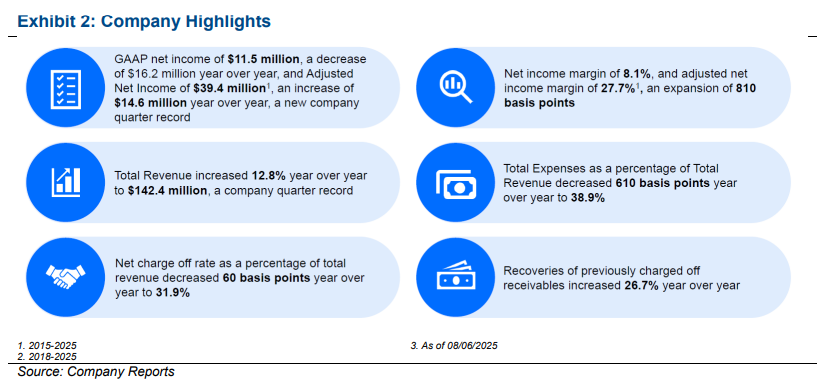

OppFi Reports 2Q25 Results

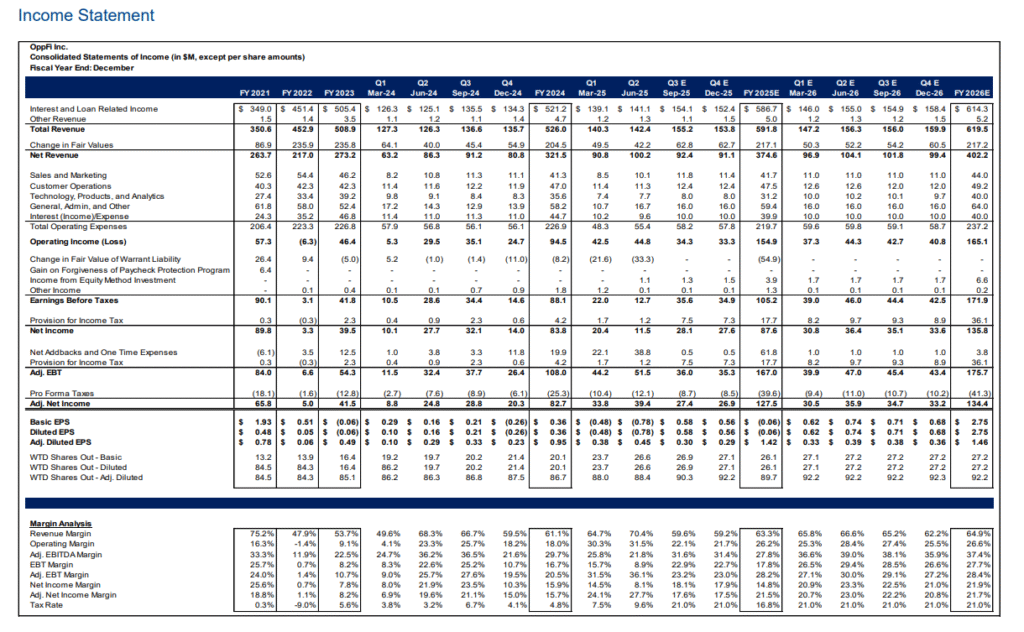

Financial Results:

OPFI reported revenue, adjusted net income, and adjusted EPS of $142.4M, $39.4M, and $0.45, respectively. This compares to our/consensus estimates of $146.4M/$141.2M, $26.9M/$26.4M, and $0.30/$0.30. Net revenue margin was 70.4% for the quarter, reflecting a year-over-year expansion of 206 bps from 2Q24. This quarter’s strong performance was driven by yet another record total revenue of $142.4M, a 12.8% y/y increase, complemented by higher receivables and portfolio yield.

Net income decreased by 58.5% y/y to $11.5M, primarily due to a non-cash warrant revaluation. Despite this, adjusted net income increased by 59.0% y/y to $39.4M — setting another new quarterly record for the Company. Adjusted EPS rose to $0.45, compared to $0.29 in the prior-year period. Adjusted net income margin expanded 810 bps y/y to 27.7%, underpinned by algorithmic credit decisioning, expense discipline, and improving credit quality.

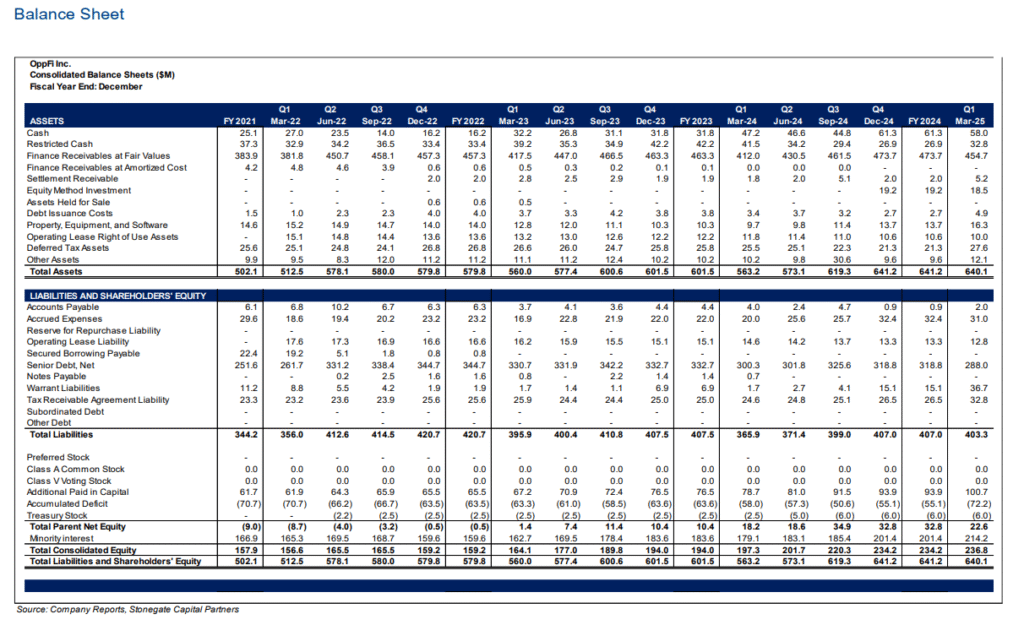

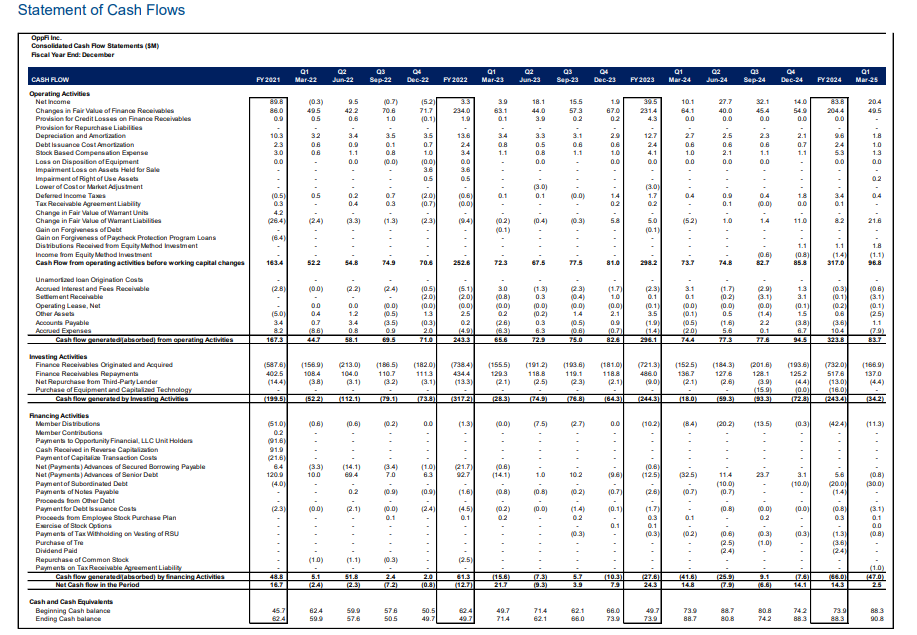

Liquidity and Balance Sheet:

OppFi ended 2Q25 with $78.3M in cash and restricted cash, including $45.2M in unrestricted cash, down from $88.3M in 4Q24. The Company maintains a total funding capacity of $603.3M, including $219.1M in undrawn debt. During 1H25, OppFi generated $64.0M in free cash flow, enabling continued investment in growth and a $28.1M special dividend paid in 2Q25. The Company also fully repaid its corporate term loan in Q1 and upsized its revolving credit facility by $50.0M.

Originations:

Total net originations for 2Q25 rose 14% y/y to $233.9M, driven by strong refinancing activity and increased demand from returning customers. Retained net originations grew 9% y/y to $205.7M, while receivables ended rose 13% y/y to $437.8M. The auto-approval rate increased to 80%, up from 76% in the prior-year period, reflecting ongoing improvements in automation and risk stratification through OppFi’s Model 6 platform.

Lending Standards:

Credit quality improved in 2Q25, with the net chargeoff rate declining to 31.9%, of total revenue, down 60 bps from the year ago and 42% in 4Q24. Annualized net charge-offs as a percentage of average receivables also fell to 43% from 44% last year, driven by enhanced credit modeling and fewer delinquent accounts. Recoveries on charged-off accounts increased 26.7% y/y, and portfolio yield reached 136%, up 130 bps y/y—a new company record. These gains are a result of enhanced underwriting models, pricing optimization, and a shift toward higher-quality borrowers.

Guidance:

On the back of continued momentum, OppFi raised its FY25 revenue guidance to $578–$605M, up from $563–$594M. The Company also increased adjusted net income guidance to $125–$130M (from $106–$113M) and adjusted EPS to $1.39–$1.44 (from $1.18–$1.26), based on a projected 90 million diluted shares. We believe OppFi remains well positioned to meet or exceed its guidance based on 1H trends.

Valuation:

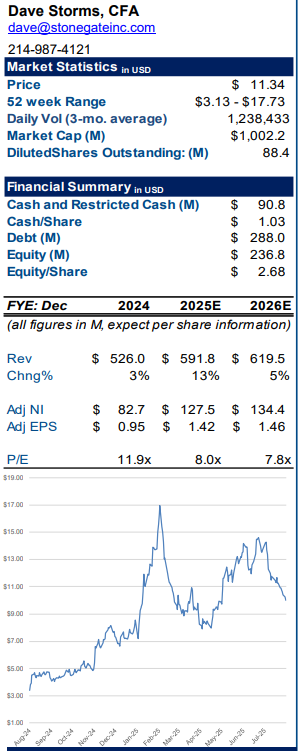

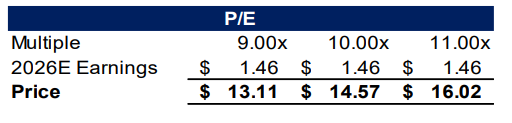

We use a P/E comp analysis to guide our valuation. Our valuation relies on a P/E multiple range of 9.0x to 11.0x with a midpoint of 10.0x. This arrives at a valuation range of $13.11 to $16.02 with a midpoint of $14.57.

Business Overview

OppFi, Inc. (“OppFi,” “OPFI,” or “the Company”) is a tech-enabled, mission-driven specialty finance platform that broadens the reach of community banks to extend credit access to everyday Americans. Through its unwavering commitment to customer service, the Company supports consumers who are turned away by mainstream options, helping them build better financial health. OppFi began trading on the NYSE under the symbol “OPFI” on July 20, 2021, following the completion of a Business Combination Agreement with FG New America Acquisition Corp.

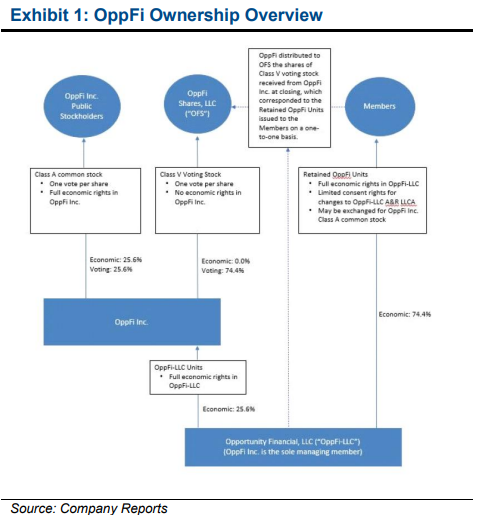

OppFi is organized in an “UpC” structure, where voting interest is split between Class A common shares and Class V common shares, and economic interest is split between Class A common shares and Members retaining OppFi units. This unique ownership structure aligns the interests of management and shareholders. OppFi units are primarily held by Founder and CEO Todd Schwartz and his family, with the remaining held by current and former employees. These units can be exchanged for Class A shares. Mr. Schwartz, who founded the company in 2012, is the largest shareholder and has also made open market purchases of Class A shares in FY23 and FY24. This alignment helps keep the mission-driven nature of OppFi at the forefront while also maintaining the economic interests of Class A shareholders.

OppLoans

OppLoans is currently the only product offered by OppFi. Banks work with OppFi to provide short-term lending options. These credit solutions are typically for approximately $1,500, repaid in installments over an average term of 11 months. The typical customer is a U.S. consumer who is employed at a median wage, has a bank account, is rejected for a loan when applying at a bank due to a low credit score, and uses the proceeds for unexpected expenses such as:

- Auto Repairs

- Housing Expenses

- Medical Expenses

- Education Opportunities

OppFi facilitates these solutions with market-leading terms, including simple terms with no origination fees, late fees, or repayment penalties. Additionally, the Company reports to the three major credit bureaus. This works in concert with OppFi’s TurnUp Program, which helps eligible applicants find more affordable borrowing options below 36% APR.

impressive customer experience ratings which include a 4.5 out of 5 on TrustPilot as of publication, an A+ rating from the BBB as of publication, and a Net Promoter Score of 79 as of 2Q25.

This has resulted in significant company highlights illustrated below:

Funding Capacity and Liquidity

As of Q2 2025, OppFi has a total funding capacity of $603.3M, including approximately $297.4M in a combination of restricted and unrestricted cash and undrawn debt. When combined with the Company’s free cash flow profile, this provides ample liquidity and flexibility to support further expansion. While we typically avoid companies with high debt levels relative to market cap, this situation is unique for OppFi. The Company maintains a revolver to fund its receivables, which is directly correlated to its receivables, providing a more strategic funding structure.

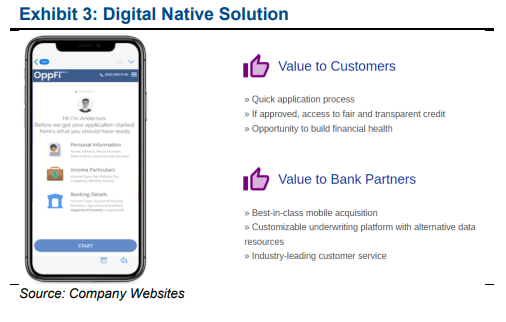

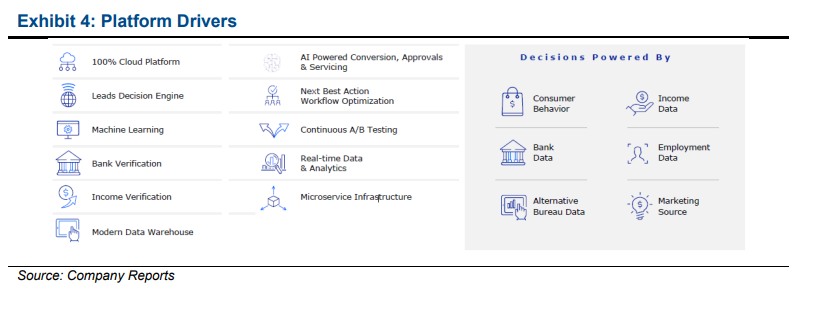

Digital Specialty Finance Platform

Crucial to OppFi’s success is the platform that it operates. This starts with the Company’s ability to facilitate credit solutions, with total net originations growing approximately 14.0% year-over-year in 2Q25. This growth is attributed to increased demand from returning customers and improvements to OppFi’s credit model, driving higher issuance for refinancing and returning customers.

Through the bank partner model, banks utilize the platform to lend, originate, contract, and fund the borrowers. OppFi’s current bank partners include FinWise, First Electric Bank, and Capital Community Bank. While the banks originate the loans, they also retain the title to and ownership of the loans at all times. However, OppFi may purchase certain participation interests in the loans at a later date while the banks retain ownership of the assets.

To facilitate credit decisions, the platform relies on over 500 data points outside of traditional FICO scores to generate a proprietary score. Applicants are evaluated based on factors like consistency of income, types of previous loans, previous repayment patterns, and employment status, among many others. OppFi believes these nontraditional methods more accurately identify consumers who are willing and able to repay loans, while helping bank partners avoid issuing loans to consumers who cannot afford or do not intend to repay.

Approximately 76% of underwriting decisions were automated in FY24, with some applicants receiving their funds on the same day their applications are approved.

OppFi TurnUp Program

As applicants go through the underwriting process, those that are eligible may choose to opt into the OppFi TurnUp Program, which voluntarily checks the market for sub-36% APR products for which the applicant may qualify. If they qualify for these lower-cost products, they are made aware of this option and can either continue their application on another lender’s platform or proceed with the OppFi platform.

Competitive Terms and Financial Education

This ability to successfully underwrite loans allows OppFi to provide very competitive terms and conditions in fair and transparent packages that allow customers to build financial health. Simple interest installment loans without balloon payments make the process as straightforward as possible. These terms, coupled with reporting to the three major credit agencies, help customers rebuild credit.

OppFi’s mission-driven ethos also drives customer satisfaction. In addition to offering financial products, OppFi provides customers and non-customers alike with access to OppU, the Company’s online financial education center. OppU helps users learn about credit building and budgeting, with the explicit goal of helping them graduate to mainstream credit products.

Small Business Advances

On August 1, 2024, the Company announced a strategic acquisition of a 35% equity interest in Bitty Advance (“Bitty”) for $17.9M, which is a 6.0x valuation based on Bitty’s $8.5M TTM adjusted net income as of 1Q24. This transaction was financed with 85% cash and 15% stock, aligning Bitty’s management with OppFi goals. Bitty is a profitable and growing platform that provides credit access to underserved small businesses, many of which have difficulty accessing traditional bank loans. This transaction includes options for OppFi to obtain majority and total ownership over time. We view this transaction as strategically beneficial as it opens the small business financing vertical for OPFI.

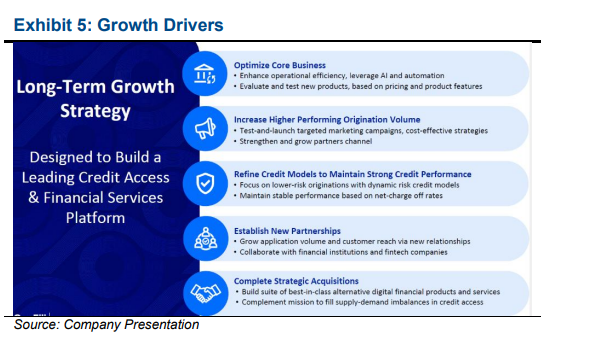

Growth Strategy

To increase market share and grow the business, management developed key organic and inorganic growth initiatives. The initiatives include driving volume growth, diversifying into new customer and product types, and serving more customers through new relationships. An overview of these priorities can be found in the following exhibit.

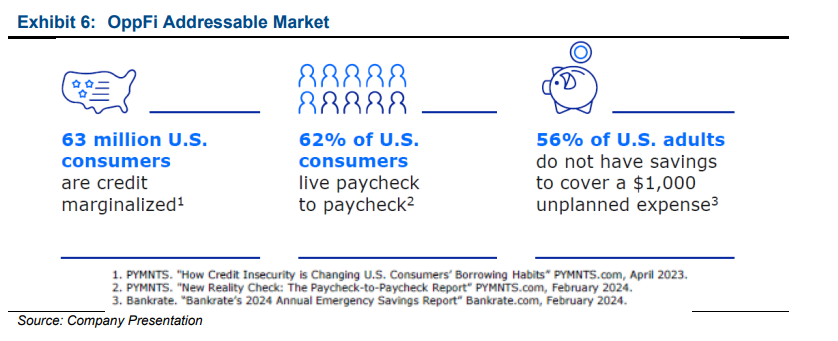

Market Overview

Demand for OppFi products is directly related to the U.S. consumer. Current estimates show that 63 million U.S. consumers are credit marginalized. Additionally, 62% of consumers are living paycheck to paycheck. This, coupled with 56% of adults not having the savings to cover unplanned expenses over $1,000, leaves OppFi products in demand.

These customers tend to be some of the most in need of fair, affordable, transparent, and flexible credit products to cover cash shortfalls. This segment of the market is not serviced by traditional banks and credit providers, primarily due to low FICO scores. OppFi can service this market due to the strong underwriting results discussed above.

When we look at this market going forward, we note that traditional banks have been slow to adopt digital technologies. Of the roughly 4,700 FDIC institutions, the majority operate with legacy technology that is not sufficiently mobile for today’s consumers. This gives OppFi a significant early adopter advantage to gather data and continue to improve its mobile and digital platform.

Risks

As with any investment, there are certain risks associated with OppFi’s operations as well as with the surrounding economic and regulatory environments common to the specialty finance industry.

- Competitive Industry – OPFI operates in a competitive industry with a number of players, some of which are larger than the Company. Should the Company fail to expand its customer base, the business may suffer.

- Regulatory Changes – The Company may be subject to regulatory changes. Government legislation and/or regulatory agencies can impose rate caps, which can negatively impact the Company’s ability to operate.

- Credit – OPFI’s customers are those with low and/or poor to no credit history. This puts the Company at significant risk of loss should a significant number of customers fail to meet their contracted repayment obligations.

- Reinvestment – OPFI has a very short duration portfolio requiring repeated reinvestment. Should appetite for OPFI’s products deteriorate, it will be challenged to recover that revenue lost.

- Partnerships – The Company depends on FinWise, FEB, and CCB to support its operations as bank partners. Should any of these partners choose to cease or limit operations, the Company may be unable to attract new bank partners, which would have a significant adverse impact on OppFi’s operations.

- Significant Ownership Concentration – Greater than 50% of both voting and economic interest is held by insiders. While we generally like to see companies with significant insider ownership, concentrated ownership allows management to exert significant control over operations. Should their interests diverge from minority owners, minority shareholders may be negatively affected.

VALUTION SUMMARY

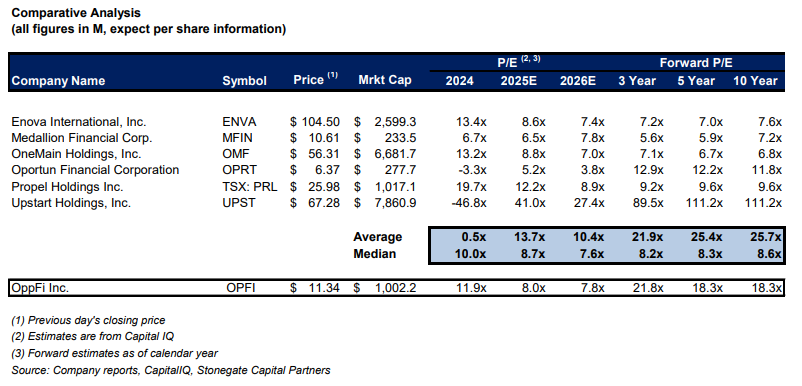

To help frame our valuation, we use a comparative analysis.

Due to OppFi’s role in the lending process, we do not believe it is appropriate to value OppFi using Book Value as we would a traditional bank or lending operation. We, therefore, rely more heavily on P/E when valuing OppFi.

We are using a P/E framework to inform our OPFI valuation. Currently, OPFI is trading at a FY26 P/E of 7.8x compared to comps at an average of 10.4x.

We note that historically, comps have traded in a range of 5.6x to 12.9x per CapIQ, and after controlling for the outlier of $UPST. We are using our FY26 expected earnings of $1.46, and a P/E range of 9.0x to 11.0x with a midpoint of 10.0x. We believe this is reasonable given the historical trading multiples of peer companies as well as the premium to comps we believe OPFI should command due to its focused revenue streams and consistent growth in excess of peers. This arrives at a valuation range of $13.11 to $16.02 with a midpoint of $14.57.

IMPORTANT DISCLOSURES AND DISCLAIMER

(a) The research analyst and/or a member of the analyst’s household do not have a financial interest in the debt or equity securities of the subject company.

(b) The research analyst responsible for the preparation of this report has not received compensation that is based upon Stonegate’s investment banking revenues.

(c) Stonegate or any affiliate have not managed or co-managed a public offering of securities for the subject company in the last twelve months, received investment banking compensation from the subject company in the last 12 months, nor expects or receives or intends or seeks compensation for investment banking services from the subject company in the next three months.

(d) Stonegate’s equity affiliate, Stonegate Capital Partners, “SCP” has a contractual agreement with the subject company to provide research services, investor relations support, and investor outreach. SCP receives a monthly retainer for these non-investment banking services.

(e) Stonegate or its affiliates do not beneficially own 1% or more of any class of common equity securities of the subject company.

(f) Stonegate does not make a market in the subject company.

(g) The research analyst has not received any compensation from the subject company in the previous 12 months.

(h) Stonegate, the research analyst, or associated person of Stonegate with the ability to influence the content of the research report knows or has reason to know of any material conflicts of interest at the time of publication or distribution of the research report.

(i) No employee of Stonegate has a position as an officer or director of the subject company.

Ratings – Stonegate does not provide ratings for the covered companies.

Distribution of Ratings – Stonegate does not provide ratings for covered companies.

Price Chart – Stonegate does not have, nor has previously had, a rating for its covered companies.

Price Targets – Stonegate does not provide price targets for its covered companies. However, Stonegate does provide valuation analysis.

Regulation Analyst Certification:

I, Dave Storms, CFA, hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report.

For Additional Information Contact:

Stonegate Capital Partners, Inc.

Dave Storms, CFA

Dave@stonegateinc.com

214-987-4121

Please note that this report was originally prepared and issued by Stonegate for distribution to their market professional and institutional investor customers. Recipients who are not market professional or institutional investor customers of Stonegate should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. The information contained herein is based on sources which we believe to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. Because the objectives of individual clients may vary, this report is not to be construed as an offer or the solicitation of an offer to sell or buy the securities herein mentioned. This report is the independent work of Stonegate Capital Partners and is not to be construed as having been issued by, or in any way endorsed or guaranteed by, any issuing companies of the securities mentioned herein. The firm and/or its employees and/or its individual shareholders and/or members of their families and/or its managed funds may have positions or warrants in the securities mentioned and, before or after your receipt of this report, may make or recommend purchases and/or sales for their own accounts or for the accounts of other customers of the firm from time to time in the open market or otherwise. While we endeavor to update the information contained herein on a reasonable basis, there may be regulatory, compliance, or other reasons that prevent us from doing so. The opinions or information expressed are believed to be accurate as of the date of this report; no subsequent publication or distribution of this report shall mean or imply that any such opinions or information remains current at any time after the date of this report. All opinions are subject to change without notice, and we do not undertake to advise you of any such changes. Reproduction or redistribution of this report without the expressed written consent of Stonegate Capital Partners is prohibited. Additional information on any securities mentioned is available on request.