GoHealth, Inc. operates as a health insurance marketplace and Medicare-focused digital health company in the United States. The company operates

a technology platform that leverages machinelearning algorithms of insurance behavioral data to optimize the process for helping individuals find the health insurance plan for their specific needs. It provides Medicare plans, including Medicare Advantage, Medicare Supplement and Prescription Drug, and Medicare Special Needs Plans. The company also offers partner marketing services. It sells its products through carriers and online platform,

as well as independent and external agencies. The Company was founded in 2001 and is headquartered in Chicago, Illinois.

Company Updates

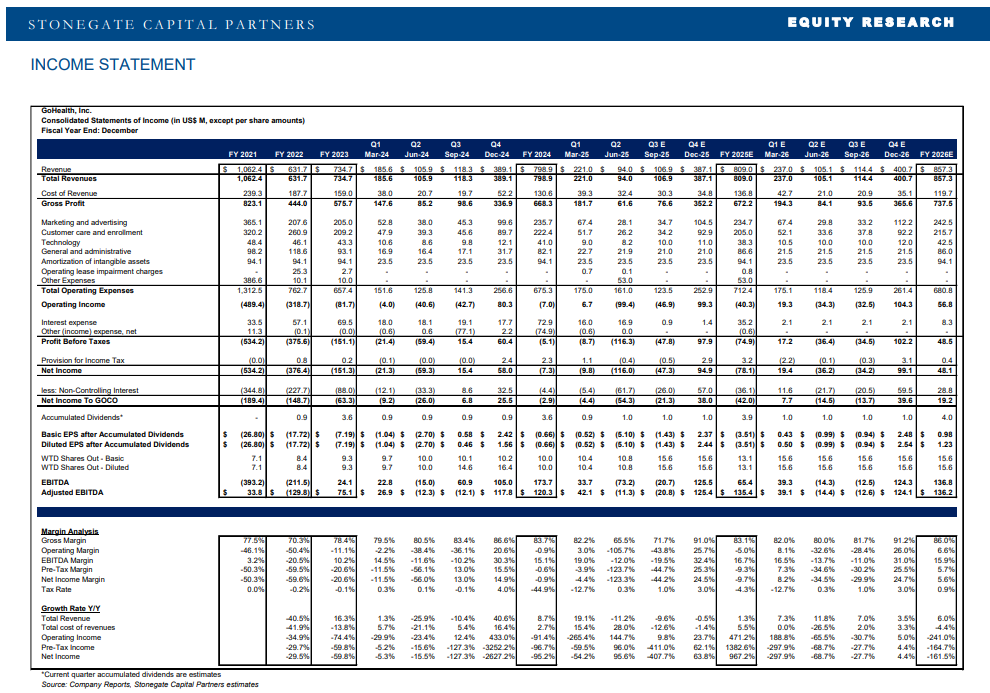

GoHealth, Inc. delivered a challenged second quarter in 2025, highlighted

by revenue declines and contracting margins. Net revenues decreased

11.2% year-over-year to $94.0M, driven by a decrease of 44.4% and 79.4%

in partner revenue and non-agency revenue, respectively. This decrease

was buoyed by a strong increase in other revenues, spearheaded by

GoHealth Protect, discussed below. This overall decline was driven in large

part by the telegraphed softness in the overall market. Management notes

that they will continue to read and react to the market, taking advantage of

opportunities where they see fit. As the Company continues through 2025,

and following the updated strategic initiatives mentioned below,

management remains focused on the upcoming AEP.

Strategic Initiatives: GoHealth’s provided a comprehensive update to its

strategic initiatives that was highlighted by the Company securing a new

senior secured super priority term loan facility. We note that this new term

loan includes $80.0M in new money, which will give GOCO ample room to

support working capital and provide strategic flexibility. This term loan brings

GOCO back into compliance with current debt covenants and leaves open

the possibility of additional acquisitions with a $250.0M debt basket for such

transactions. We view this, along with the equity stake granted in this

transaction, as the lenders vote of confidence in the Company’s ability to

grow, given sufficient funds. In concert with this new loan, GOCO has

negotiated amendments to its current debt facility, allowing for a reset of

financial covenants and a pause in interest rate payments through 2026.

Overall, we are impressed with management’s creativity in shoring up the

balance sheet, allowing GOCO to turn its focus on the upcoming AEP.

Sales: In 2Q25 the Company saw sales per submission decline by 4.8% y/y

to $657. This was driven by the macro headwinds that the entire industry is

facing. This was seen as agency revenue decreased by 4.1% while nonagency revenue declined by 79.4% year over year. Of note, the Company

saw strong other revenues of $8.7M as it continues to ramp up the GoHealth

Protect initiative. We expect that the continued integration of GoHealth

Protect will smooth out some of the lumpiness seen in the Company’s

revenue streams. While the sales to direct operating costs of submission

remained flat y/y at 1.1, this decrease in revenue contributed to a tightening

spread between sales per submission and cost of customer acquisition.

Cost of Acquisition: GOCO maintained a competitive cost of customer

acquisition in the quarter with average CAC of $613. This was an

improvement of 4.8% year over year. While margins did contract slightly,

when considering the current macro environment we are impressed with the

Company’s cost management. We expect GOCO to continue focusing on

cost management through initiatives such enhancing call center productivity,

better agent training, and improved marketing strategies.

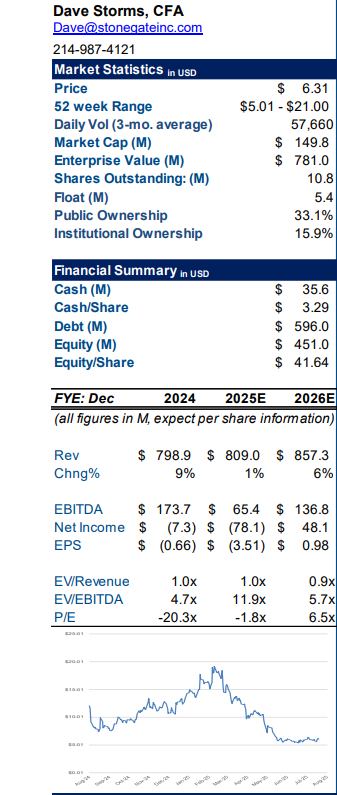

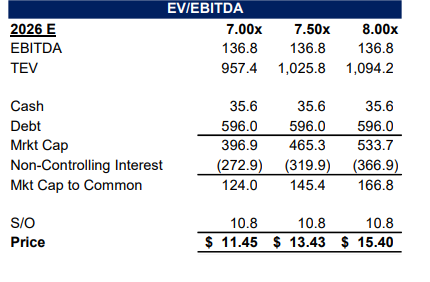

Valuation: We use a EV/EBITDA comp analysis to guide our valuation. We

are using our FY26 expected EBITDA, and an EV/EBITDA range of 7.0x to

8.0x with a midpoint of 7.5x which moves GOCO closer to comp companies.

Our EV/EBITDA valuation results in a range of $11.45 to $15.40 with a midpoint of $13.43.

Business Overview

GoHealth, Inc. is a leading health insurance marketplace and Medicare-focused digital health company dedicated to improving access to healthcare across the United States. The Company’s mission centers on simplifying the often-complex process of enrolling in health insurance plans, ensuring consumers can make informed decisions that best suit their healthcare needs. By leveraging advanced technology, data analytics, and deep industry expertise, GoHealth matches customers with optimal healthcare policies and carriers. Since its inception, the Company has successfully enrolled millions of individuals in Medicare, as well as individual and family plans.

Founded with the vision of transforming the

health insurance landscape, GoHealth has eveloped a platform that addresses the challenges consumers face when selecting insurance plans. The subtle differences

between plans can lead to significant out-ofpocket expenses or restricted access to essential medications and providers.

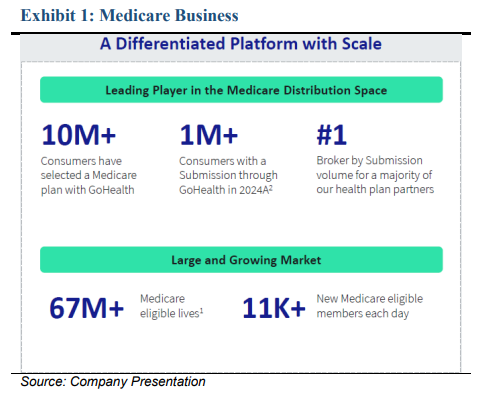

GoHealth’s platform demystifies these complexities, providing clear comparisons and personalized recommendations to guide consumers toward the most suitable options. Today, GoHealth is the leading player in the Medicare distribution space, having helped over 10 million consumers select a Medicare plan. In 2024 alone, the Company processed over 1,000,000 submissions, reinforcing its position as the #1 broker by submission volume for many of its health plan partners.

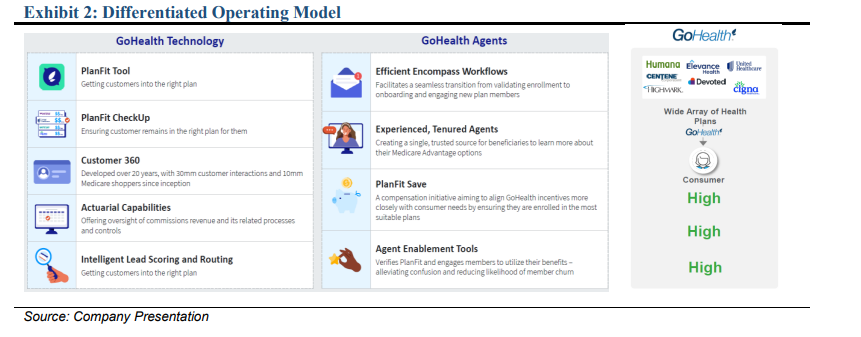

GoHealth has evolved significantly from its early days as a high-volume Medicare distributor focused on a health plan-centric telephonic sales approach to becoming a consumer-centric, technology-driven leader in the Medicare space. Initially, the Company relied on large sales and marketing spending to meet annual enrollment period targets, but today, it operates a streamlined, standardized Encompass model that enhances efficiency and reduces revenue risk. Its scale has expanded from merely partnering with major health plans to offering high-quality, five-star plans across all 50 states, ensuring consumers receive the best coverage options. Furthermore, GoHealth has transformed its financial model, shifting from negative cash flow due to high upfront costs to generating substantial cash flow from high-quality enrollments and back-book policies,reinforcing its long-term sustainability and market leadership.

The Company’s revenue model primarily hinges on commissions earned from insurance carriers for each policy sold through its platform. These commissions vary based on the type and value of the insurance policy, offering a scalable and performance-based revenue stream. Additionally, GoHealth benefits from renewal commissions, as many health insurance policies renew annually, ensuring ongoing revenue from long-term policyholders.

In recent years, GoHealth has expanded its services to capture a broader range of healthcare solutions, reinforcing its commitment to enhancing healthcare accessibility. The Company’s dedication to innovation and customer-centric solutions has solidified its position as a trusted intermediary between consumers and insurance providers.

Financial Drivers and Platform Overview Revenue

- Two Types of Agents: GoHealth employs two types of agents; Internal agents (“Captive”) and external GoPartner Solutions (“GPS”) agents. Internal captive agents are directly employed by GoHealth and focus on providing personalized service and support to consumers. These services include but are not limited to, assisting and maintaining Medicare-eligible consumers with their enrollment process through GoHealth. Conversely, external GPS agents operate independently but are integrated into GoHealth’s system, allowing them to leverage GoHealth’s technology platform. Importantly, GPS agents generate their own marketing efforts, offering GoHealth’s services to a broader audience while benefiting from the company’s robust infrastructure and resources. This model allows GoHealth to expand its reach and maintain high standards of service and compliance.

- PlanFit Tool: Through the Company’s Encompass Platform (discussed further below), agents use the PlanFit Tool to determine the optimal plan for a prospective customer. This helps to streamline the process for agents increasing throughput and decreasing costs. For the customers this also ensures that any plan they select is the optimal one for their unique needs, solidifying the relationship that customers have with GOCO.

- Two Types of Contracts: GoHealth operates with two primary types of contracts; agency and nonagency. Agency contracts are any contract sourced by either Captive agents or GPS agents. These involve commissions from health plan partners for policies sold, including initial and renewal commissions. GOCO will then pay a commission to the agent that sourced this contract. Non-agency contracts involve enrollment and engagement services for which GoHealth is not the agent and is instead generating the lead for the health plan partners. In non-agency contracts GOCO collects fees directly from consumers or health plan partners once the contract is sold and does not receive

commissions for renewals. - Revenue Recognition: For non-agency contracts GoHealth receives cash fees once the customer is enrolled. For agency contracts GoHealth estimates the amount of revenue that a given contract will generate between initial commissions and renewal commissions known as the Lifetime Value of Commissions (LTV). The Company relies on its historical experience to make these estimations. GOCO re-estimates LTV at a vintage level for all of its outstanding vintages quarterly and makes adjustments as deemed necessary. This approach allows GoHealth to recognize revenue in a manner that matches the expected cash flows from the policies.

Costs

- Customer Acquisition Channels: GoHealth acquires customers through various channels, including direct mail, television, and digital marketing. These channels are optimized to reach a broad audience and drive high-quality leads. As of FY24, Marketing and advertising expenses made up ~33% of total operating expenses, representing the crucial role they play in customer acquisition.

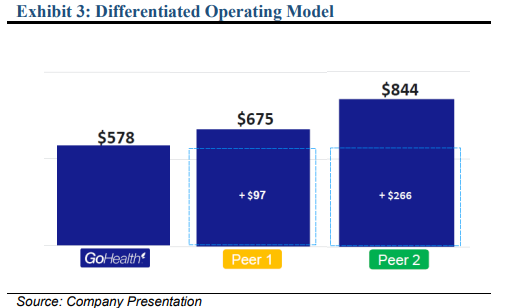

- Customer Acquisition Cost (CAC): The average CAC for GoHealth is ~$578 as of 4Q24, which is competitive compared to industry peers whose CAC can amount to anywhere between ~$675- $845 (refer to Exhibit 4). This efficiency is attributed to GoHealth’s advanced marketing strategies and technology-driven approach. As a result, GoHealth’s costs are coming down due to their effective use of AI and automation, which streamline operations and reduce overhead. This has led to a significant reduction in the Direct Operating Cost per Submission. In FY24, Technology and Customer Care & Enrollment costs decreased by ~10% as compared to FY23.

Encompass Platform

- Technology Stack: The Encompass platform integrates customer relationship management,

agent productivity tools, and advanced data analytics to streamline the insurance enrollment

process. This comprehensive “tech stack” enhances operational efficiency and provides a seamless

experience for both agents and consumers.

AI-Enabled: Encompass is powered by AI-driven PlanFit technology, which optimizes plan selection and benefit utilization. This technology ensures that consumers are matched with the best Medicare plans based on their specific needs, resulting in higher satisfaction and retention rates.

PlanFit CheckUp: As part of the Encompass Solution Platform GoHealth’s proprietary PlanFit CheckUp tool helps consumers regularly assess their Medicare plans to ensure they are still appropriate for their needs. This proactive approach builds trust and drives retention by incentivizing agents to provide unbiased advice. As a result, GoHealth fosters long-term relationships with consumers as they feel confident that they are in the best plan for their needs. To incentive agents to provide the best possible outcome for customers, GOCO will still pay a commission even if the agent does not sell a new product. This removes significant amounts of churn from the process, further improving customer relationships.

Ability to Make Acquisitions

- e-TeleQuote Acquisition: GoHealth’s acquisition of e-TeleQuote Insurance, Inc., added significant value to the company by expanding its agent capacity by around 400 and enhancing its market position ahead of a pivotal Medicare Annual Enrollment Period (“AEP”). The acquisition included approximately $90.5 million in contract assets and $22.5 million in cash, reinforcing GoHealth’s ability to drive growth through strategic acquisitions.

Market Overview Segments

The market operates through distinct business segments designed to cater to various aspects of health insurance needs, ensuring comprehensive coverage and specialized services for those who do not get health insurance through their employer. GoHealth primarily provides solutions for customers who quality for Medicare.

Medicare Segment: This segment focuses on assisting

consumers eligible for Medicare, offering a range of

plans including Medicare Advantage, Medicare Supplement, and Prescription Drug Plans. GoHealth’s platform provides tools and resources to help beneficiaries understand their options and enroll in plans that align with their healthcare needs and financial situations.

- Part A: (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Part B: (Medical Insurance): Includes doctor visits, outpatient care, medical equipment, and preventive services.

- Part C: (Medicare Advantage): An alternative to Original Medicare, these plans are offered by private companies approved by Medicare and include Part A, Part B, and usually Part D coverage.

- Part D: (Prescription Drug Coverage): Provides coverage for prescription medications, helping to lower

prescription drug costs.

Individual and Family Plans (IFP) Segment: This segment is for individuals under 65 and families seeking

health insurance, there are various solutions in the market that cater to individuals and family plans. GoHealth

aids consumers in comparing plan benefits, costs, and network coverage to make informed decisions. Small Business Segment: Recognizing the unique needs of small businesses, as small businesses tend to have unique needs with nuanced constraints compared to large employers. Providers service this segment offers guidance on selecting group health plans that balance comprehensive coverage with cost-effectiveness.

Growth Outlook

The U.S. health insurance market is undergoing significant growth, driven by demographic shifts, regulatory changes, and technological advancements. Through 2025, the market is projected to reach approximately $1.76 trillion, with an average per capita expenditure of $5,140. This growth is largely fueled by an aging population and increased awareness of the importance of health coverage.

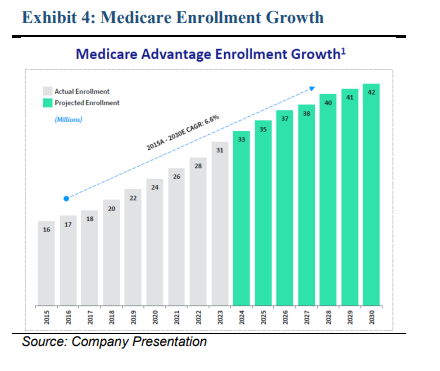

The Medicare segment is experiencing substantial expansion due to the rising number of individuals aged 65 and older. As the baby boomer generation continues to age, the demand for Medicare plans increases, presenting a significant opportunity for companies like GoHealth. In the 2025 open enrollment period, over 24.2 million consumers selected coverage through the Marketplaces, including 3.9 million new consumers, more than double the number of enrollees compared to 2021.

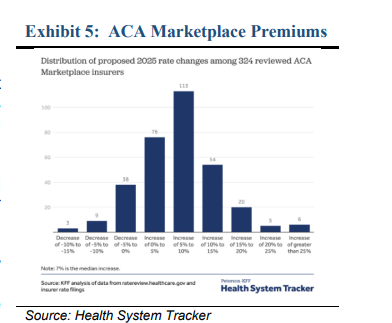

The individual and family plans market remains highly competitive, with consumers seeking affordable options

that offer comprehensive coverage. For 2025, across 324 insurers participating in the 50 states and DC, there is a median proposed premium increase of 7%, similar to the previous year. Factors contributing to this rise include healthcare price inflation and increased utilization of specialty drugs.

GoHealth Positioning

Technological advancements have transformed how consumers interact with health insurance providers. There is a growing preference for digital platforms that offer personalized plan comparisons, real-time support, and streamlined enrollment processes. GoHealth’s user-friendly digital marketplace aligns with this trend, attracting tech-savvy consumers seeking convenient and efficient ways to obtain health coverage.

The company’s proprietary Encompass Platform integrates various aspects of the insurance enrollment process, enhancing operational efficiency and ensuring a seamless experience for both agents and consumers. Operating within a complex and ever-evolving regulatory landscape, GoHealth remains agile in adapting to changes in

healthcare policies and regulations. This adaptability enables the Company to seize opportunities arising from policy adjustments, such as expanded access to health insurance or modified enrollment procedures, thereby broadening its

potential customer base. The Centers for Medicare & Medicaid Services (CMS), as GoHealth’s regulator, acknowledges the Company’s efforts in making Medicare more accessible and valuable to consumers, ensuring that GoHealth’s platform remains a trusted resource for navigating Medicare options. As the U.S. population ages, with individuals becoming eligible for Medicare upon turning 65, GoHealth is well-positioned to serve this expanding demographic. The Company’s platform effectively connects with older adults, including those previously disengaged or underinsured, offering them access to Medicare Advantage

Plans that meet their healthcare needs. The CMS recognizes GoHealth’s value in making Medicare accessible and understandable, ensuring that even the most complex aspects of Medicare are navigable for consumers. The healthcare industry’s shift towards digital solutions has increased the demand for online platforms that simplify insurance enrollment. GoHealth’s user-friendly digital marketplace aligns with this trend, attracting tech-savvy consumers seeking convenient and efficient ways to obtain health coverage. The Company’s proprietary technology, including the AI-driven PlanFit tool, enhances the consumer experience by providing personalized plan recommendations and real-time support.

Risks

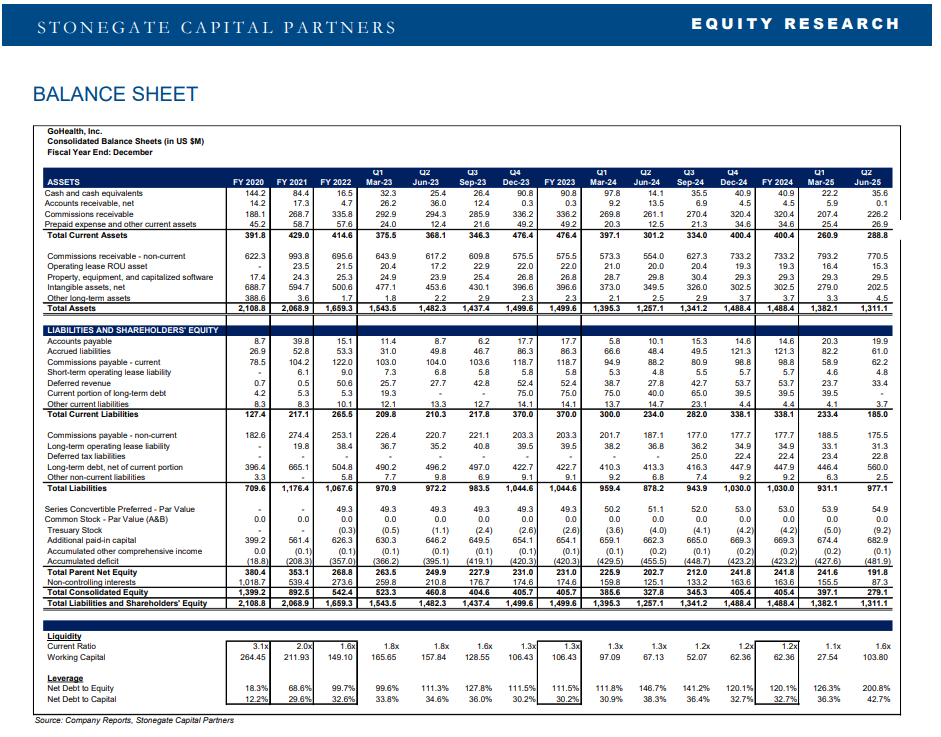

- Unmanageable Debt: The Company currently has a net debt to equity ratio above 100%. A high level of debt could strain the Company’s liquidity, limit its financial flexibility, and increase vulnerability to rising interest rates or operational downturns.

- Lifetime Value (LTV) Risk: The Company’s valuation and financial projections depend on expected lifetime value (LTV) assumptions of customers. Any miscalculations or shifts in customer behavior could lead to revenue shortfalls.

- Regulatory Uncertainty: Changes in healthcare regulations, including those related to Medicare and insurance marketplaces, could significantly impact GoHealth’s business model, profitability, and compliance costs. Exhibit 5: ACA Marketplace Premiums Source: Health System Tracker 7.

Valuation Overview

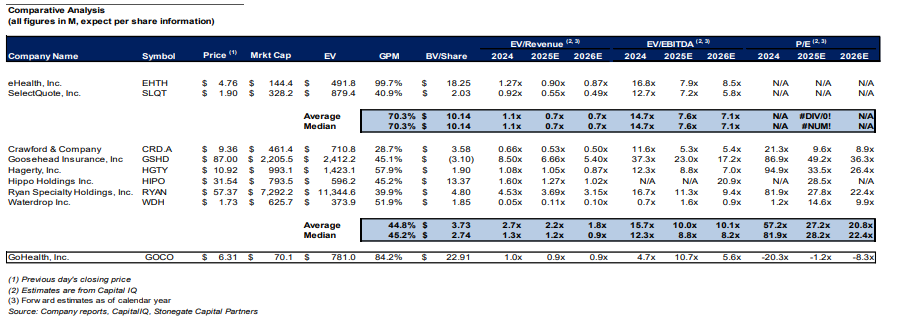

When valuing GOCO we rely on a comparative analysis. In deterring comp companies, we note that there are very few publicly traded direct competitors (eHealth and SelectQuote) and several publicly traded insurance brokers that are tangential competitors. Differences between direct competitors and tangential competitors include the GPM, typically driven by a higher level of automation and technical prowess, combined with a more defensible regulatory moat. Despite this, direct comps tend to trade at a slight discount to tangential comps, reflecting the nature of small sample sizes. Even still, direct and tangential comps were trading at a FY24 median EV/EBTIDA premium to GOCO of 216% and 164%, respectively.

When we consider the strong CAC and continued diversification of revenue streams that GOCO has, we believe it should be trading slightly ahead of direct competitors and closer to tangential comps. With direct and tangential comps trading at FY26 median EV/EBITDA of 7.1x and 8.2x, respectively, this represents a premium to GOCO of 24.5% and 44.0%, respectively, when using our FY26 estimated EBITDA. Due to GOCO’s strong regulatory moat, superb and growing margins from a lower CAC, and proven ability to grow both organically and by acquisition we believe GOCO should be trading in a forward EV/EBITDA range of 7.0x to 8.0x with a midpoint of 7.5x. Once we apply a minority interest adjustment of 0.7x, which includes the equity portion of the new term loan, we arrive at a valuation range of $11.45 to $15.40 per share, with a midpoint of $13.43.

IMPORTANT DISCLOSURES AND DISCLAIMER

(a) The research analyst and/or a member of the analyst’s household do not have a financial interest in the debt or equity securities of the subject company.

(b) The research analyst responsible for the preparation of this report has not received compensation that is based upon Stonegate’s investment banking revenues.

(c) Stonegate or any affiliate have not managed or co-managed a public offering of securities for the subject company in the last twelve months, received investment banking compensation from the subject company in the last 12 months, nor expects or receive or intends or seek compensation for investment banking services from the subject company in the next three months.

(d) Stonegate’s equity affiliate, Stonegate Capital Partners, “SCP” has a contractual agreement with the subject company to provide research services, investor relations support, and investor outreach. SCP receives a monthly retainer for these non investment banking services.

(e) Stonegate or its affiliates do not beneficially own 1% or more of any class of common equity securities of the subject company.

(f) Stonegate does not make a market in the subject company.

(g) The research analyst has not received any compensation from the subject company in the previous 12 months.

(h) Stonegate, the research analyst, or associated person of Stonegate with the ability to influence the content of the research report knows or has reason to know of any material conflicts of interest at the time of publication or distribution of the research report.

(i) No employee of Stonegate has a position as an officer or director of the subject company.

Ratings – Stonegate does not provide ratings for the covered companies.

Distribution of Ratings – Stonegate does not provide ratings for covered companies.

Price Chart – Stonegate does not have, nor has previously had, a rating for its covered companies.

Price Targets – Stonegate does not provide price targets for its covered companies. However, Stonegate does provide valuation analysis.

Regulation Analyst Certification:

I, Dave Storms, CFA, hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report. For Additional Information Contact:

Stonegate Capital Partners, Inc.

Dave Storms, CFA

Dave@stonegateinc.com

214-987-4121

Please note that this report was originally prepared and issued by Stonegate for distribution to their market professional aninstitutional investor customers. Recipients who are not market professional or institutional investor customers of Stonegate should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. The information contained herein is based on sources which we believe to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. Because the objectives of individual clients may vary, this report is not to be construed as an offer or the solicitation of an offer to sell or buy the securities herein mentioned. This report is the independent work of Stonegate Capital Partners and is not to be construed as having been issued by, or in any way endorsed or guaranteed by, any issuing companies of the securities mentioned herein. The firm and/or its employees and/or its individual shareholders and/or members of their families and/or its managed funds may have positions or warrants in the securities mentioned and, before or after your receipt of this report, may make or recommend purchases and/or sales for their own accounts or for the accounts of other customers of the firm from time to time in the open market or otherwise. While we endeavor to update the information contained herein on a reasonable basis, there may be regulatory, compliance, or other reasons that prevent us from doing so. The opinions or information expressed are believed to be accurate as of the date of this report; no subsequent publication or distribution of this report shall mean or imply that any such opinions or information remains current at any time after the date of this report. All opinions are subject to change without notice, and we do not undertake to advise you of any such changes. Reproduction or redistribution of this report without the expressed written consent of Stonegate Capital Partners is prohibited.

Additional information on any securities mentioned is available on request.