BlackSky Technology, Inc. is a space-based intelligence company that delivers real-time imagery, analytics and high-frequency monitoring of the world’s most critical and strategic locations, economic assets, and events. BlackSky designs, owns, and operatesan industry leading low earth orbit small satellite constellation. This constellation relays space-based data to BlackSky Spectra, the Company’s tasking and analytics software platform. BKSY was established in 2014 and is headquartered in Herndon, VA. BKSY is listed on the New York Stock Exchange under the ticker symbol “BKSY”.

Company Updates

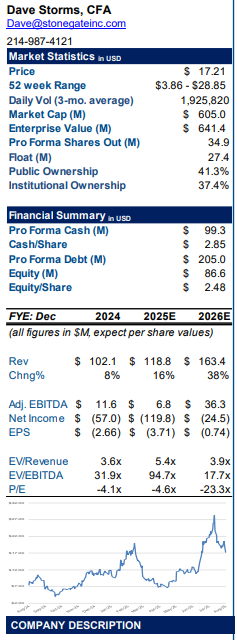

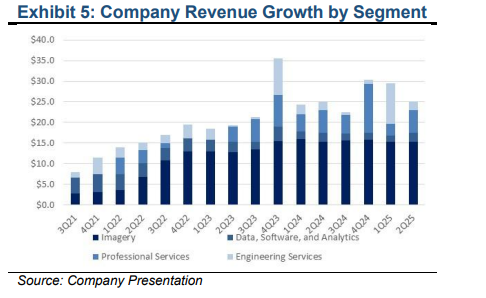

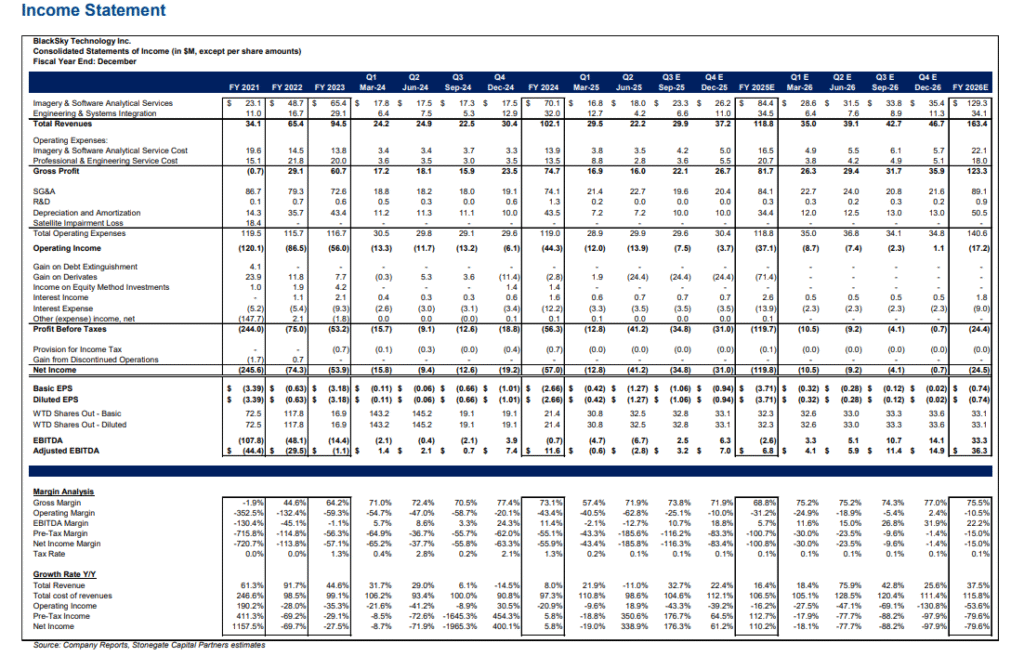

Financial Results: BKSY reported revenue, adj EBITDA, and EPS of

$22.2M, ($2.8)M, and ($1.27), respectively. This compares to our/consensus

estimates of $22.2M/$22.2M, ($1.5)M/($1.3)M, and ($0.48)/($0.48). Imagery

and Software Analytical Services revenue increased to $18.0M, up 2.9% y/y,

reflecting growing demand and early access activity related to Gen-3 imagery. Professional and Engineering Services revenue declined to $4.2M from $7.5M in 2Q24, due to timing differences in milestone-based contract recognition. Adj. EBITDA had a loss of ($2.8M) versus a $2.1M profit in the prior year, reflecting lower professional services revenue and ongoing investment in Gen-3 and AROS initiatives. Consolidated gross margins fell slightly to 71.9%, a decrease from 72.4% in 2Q24. Contracts: As of 2Q25, BKSY secured over $35.0M in new contracts, growing its total backlog to $356.0M, ~85% of which is from international customers. Key wins included a $24.0M NGA Luno A monitoring award, a multi-year Gen-2/Gen-3 contract with a new international defense customer, and a renewed early access agreement in support of Ukraine. The Company also expanded into Latin America with a Gen-2/Gen-3 On-Demand contract and advanced its Gen-3 architecture through a follow-on U.S. Navy research award focused on optical inter-satellite link (OISL) technology. These wins reinforce BKSY’s growing role as a trusted intelligence partner globally.

Gen-3 Satellite Launch: In the quarter, the Company successfully launched

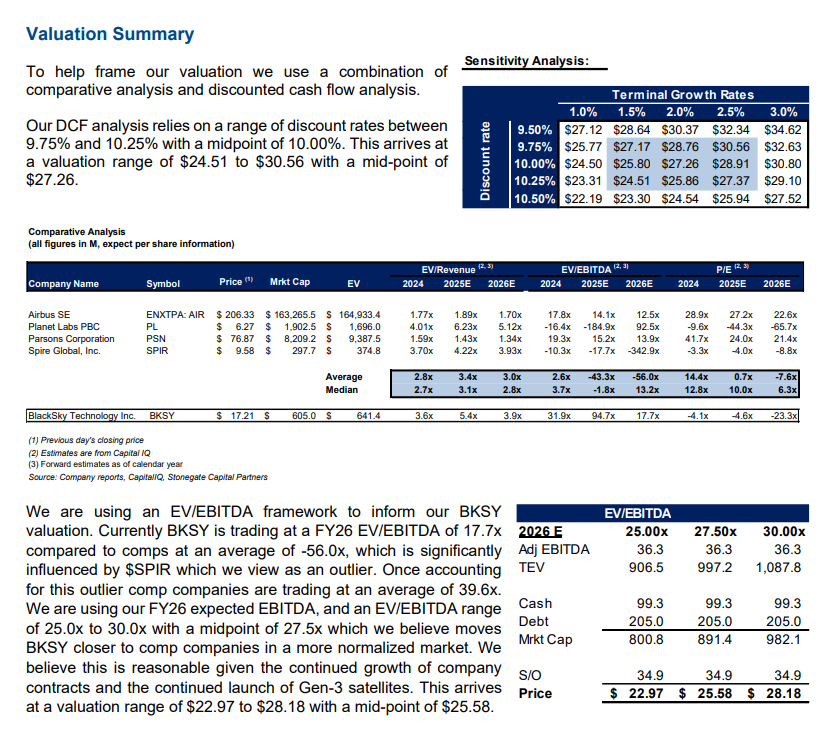

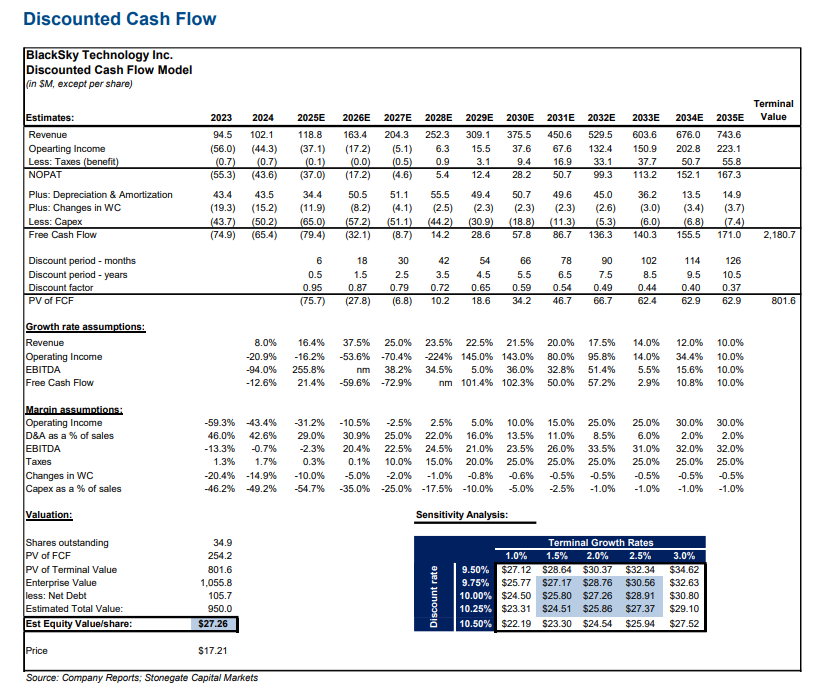

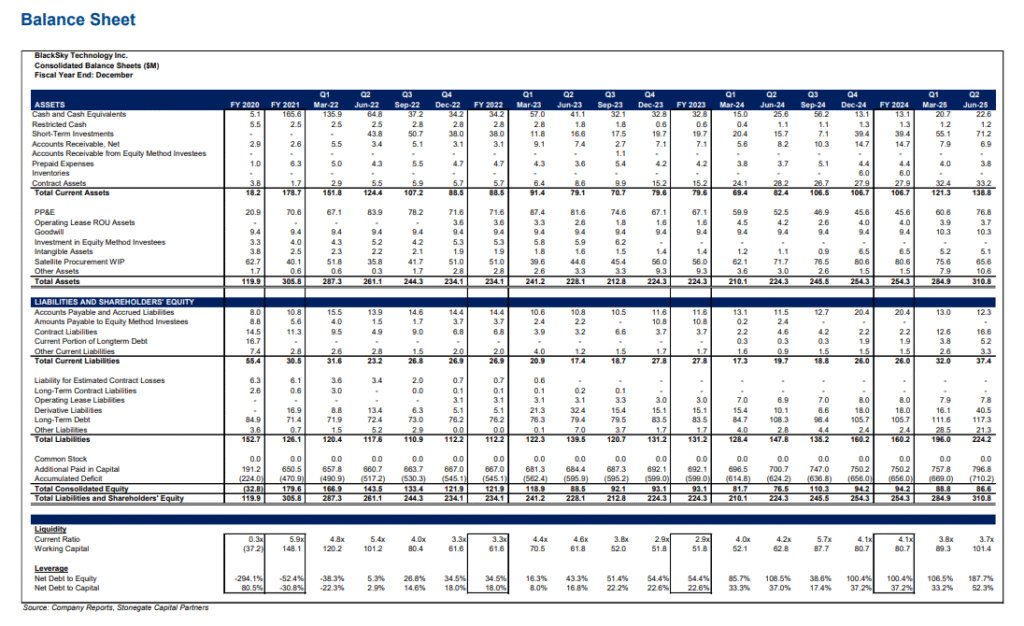

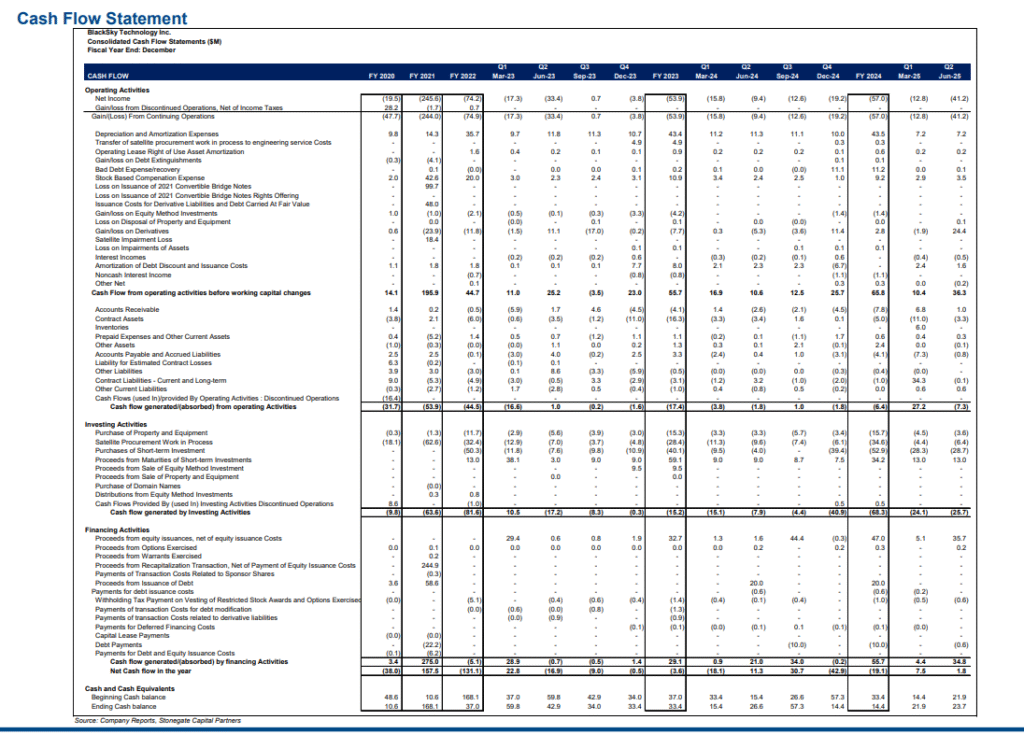

and commissioned its second Gen-3 satellite, which began delivering veryhigh resolution (35cm-class) imagery within 12 hours of launch. Multiple early access agreements have been signed with international defense and intelligence customers, highlighting growing confidence in the system’s tipand-cue utility when integrated with Gen-2 data. The third Gen-3 satellite is in final testing and expected to ship imminently. The Company remains on schedule to deploy six Gen-3 satellites in 2025 and eight by early 2026, with commercial availability beginning in 4Q25. Balance Sheet and Liquidity: BKSY significantly strengthened its balance sheet during the quarter, completing a $185.0M upsized convertible note offering. Proceeds were used to retire $113M in outstanding debt. We calculate pro-forma cash at $99.3M which includes cash on the 2Q25 balance sheet, proceeds from the warrant conversion, and proceeds from the debt offering. This capital raise reduces debt servicing cost and positions the Company for continued investment in Gen-3 and the AROS constellation. Guidance: BKSY reaffirmed its FY25 revenue guidance of $105M–$130M and adjusted EBITDA of breakeven to $10M, citing short-term U.S. government budget volatility. CapEx guidance remains unchanged at $60M–$70M. The Company expects stronger 2H25 revenue driven by increased Gen-3 availability, backlog conversion, and seasonal contract timing. We view this guidance as reasonable and have adjusted our model accordingly. Valuation: We use a DCF Model and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $24.51 to $30.56 with a mid-point of $27.26. Our EV/EBITDA valuation results in a range of $22.97 to $28.18 with a mid-point of $25.58.

Business Overview

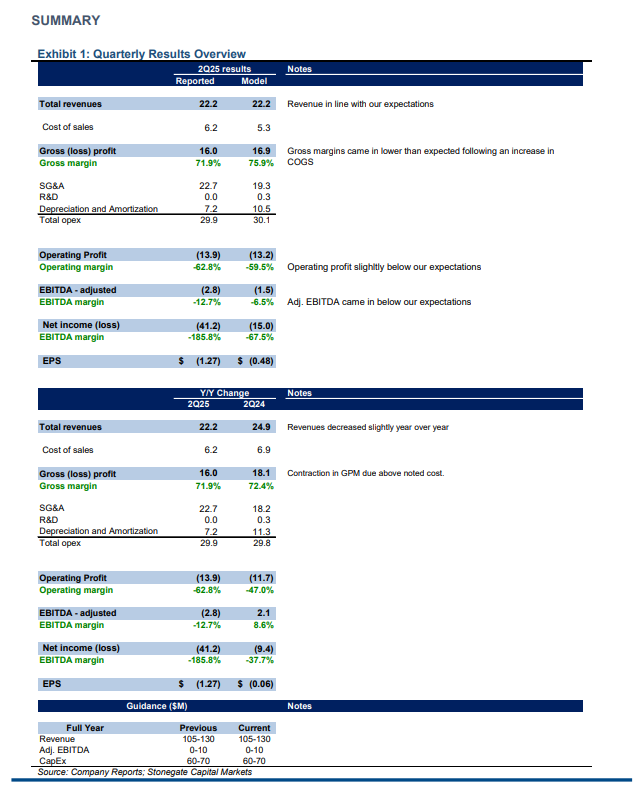

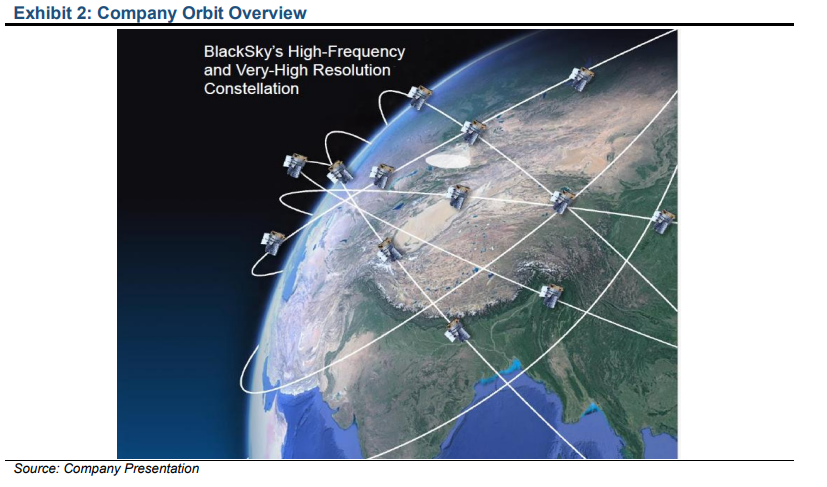

BlackSky Technology, Inc. (“BlackSky”, “BKSY”, or “the Company”) is a space-based intelligence company that delivers real-time imagery, analytics, and high-frequency monitoring of the world’s most critical and strategic locations, economic assets, and events. BlackSky designs, owns, and operates an industry leading low earth orbit small satellite constellationThis constellation relays space-based data to BlackSky Spectra, the Company’s tasking and analytics software platform. BlackSky was established in 2014 and is headquartered in Herndon, VA. BlackSky is listed on the New York Stock Exchange under the ticker symbol “BKSY”.

The Company holds contracts with a number of agencies, being trusted by allied military and intelligence organizations to provide timely insights. This is achieved by BlackSky’s satellites that fly in an unconventional midinclination orbit, which allows for imaging up to 15 times per day over a landmass that contains 90% of the world’s GDP. This is compared to traditional companies which can only image up to twice per day. This gives

customers the ability to dynamically monitor locations on-demand from dawn to dusk. When combined with BlackSky Spectra this imaging is analyzed through proprietary AI enabled software allowing for new vertical market solutions and actionable intelligence. This platform is highly scalable as the continuous expansion of data both grows the data lake and allows for expansion of analytics.

Services and Products

The Company generates revenue by selling on-demand and assured product and service offerings to both government entities and private entities across the world. The backstop of this is the Company’s satellite constellation. In the fourth quarter of 2024, Blacksky introduced the most advanced satellite to date; the Gen-3 satellite. This new technology enhances the Company’s capabilities with very-high resolution imagery and high-frequency monitoring. The

Company is also currently operates its existing Gen-2 constellation. This constellation provides a unique value with the ability to collect imagery and analytics from dawn-until-dusk at a higher .

Features such as roads and buildings, and gauge commercial activities and patterns such as movements from ships in ports, progress at construction sites, and changes in production such as the number of cars in a parking lot, all completely automated using BlackSky’s Spectra software platform. This ability for highrevisit rate imaging and on-demand satellite tasking gives BKSY a significant advantage over legacy satellite imaging providers. BKSY breaks its revenue streams into four main categories. cadence and at lower cost than traditional providers. U.S. and allied militaries rely on BKSY services for highrevisit monitoring of airfields, vehicle depots, troop movements, and other high-value locations to detect changes in pattern-of-life. BlackSky can distinguish landscape.

Imagery – The imagery segment offers high–revisit, high-resolution, satellite imaging products. With the launch of the Gen-3 satellites, customers can now access the highest resolution imagery and improved monitoring capabilities through the BlackSky Spectra software platform. In the platform, customers can directly task the constellation to collect and deliver imagery over specific locations, sites, and regions that are critical to their operations. All imagery products are included in the basic subscription plan for OnDemand tasking. Another option is the Assured access bundle program, where customers receive secure priority access and imaging capacity over a region of interest on a take or pay basis. Data, Software, and Analytics – The Company also offers subscription–based AI-generated analytics that provide customers with automated access to site monitoring, event monitoring, and global data. Additional services include anomaly detection and enhanced analytics at critical locations. These critical locations include infrastructure such as ports, airports, and construction sites; retail activity; commodities stockpiles; and other sites that contain critical commodities and inventory. Professional Services – BlackSky also provides professional service solutions to support customerspecific software feature requests and the integration, testing, and training of the imagery and software analytical services into a customer’s organizational processes and workflows. This consultant adjacent service is highly profitable for the Company, as it has potential to lead to strong recurring revenues. Engineering Services – BlackSky also provides engineering services, which include, developing and delivering advanced satellite and payload systems for a limited number of customers that leverage the Company’s capabilities in mission systems engineering and operations, ground station operations, and software and systems development. In this model, satellite and payload systems are typically sold to government customers or government resellers under a fixed price contract with additional revenue streams for ongoing support and services once the satellite is in orbit. These contracts allow BlackSky to maintain its production line at scale, benefit from technological developments, and creates further opportunity for ongoing subscription-like contracts.

Competitive Advantages

The Company has competitive advantages on both the hardware and software sides of its business. On the hardware side BlackSky is in the process of implementing its next generation (Gen-3) satellite constellation, with the design completed. The Gen-3 constellation will expand imaging capabilities in lowlight or night-time situations using infrared imaging technology. Gen-3 will also feature improved date communication abilities to reduce latency. By improving the imaging resolution quality from about 80cm in the Gen-2 satellites to 35cm in the new Gen-3 satellites, BlackSky remains on the forefront on imaging capabilities. The first Gen-3 satellite was successfully launched in 1Q25, delivering very-high resolution imagery and exceeding customer expectations.

To continue to manufacture its Gen-3 satellites BKSY has a 50% ownership in LeoStella, a satellite manufacturer. LeoStella has the capabilities to manufacture up to 40 satellites per year, giving BlackSky control over the entire design, manufacturing, and operations of its hardware. BlackSky also has a decided advantage due to its software capabilities. The BlackSky Spectra platform can process millions of observations a day from both BKSY’s constellation, as well as external sources that include radar, radio frequency, environmental sensors, Internet of Things devices, asset tracking sensors, and various other third-party news sources and data feeds. The analytics provided by BlackSky Spectra are easily accessible to clients via web interface or APIs. Using these interfaces customers can also task the constellation to receive imagery and analytics directly to email, ERP system, or cloud environment in under 90 minutes on average. These capabilities can also be delivered to customers as a flexible API kit that enables integration of BKSY capabilities into customers’ existing platforms.

Market Overview

The geospatial market that BKSY operates in, that includes both imaging services and analytics solutions, is large and growing. Space-based intelligence is playing an increasingly critical role in decision-making for government agencies, commercial enterprises, and organizations around the world. At the same time, a growing number of government defense and intelligence agencies are increasing their reliance on commercial satellite providers to complement their in-house geospatial data sources. According to Markets and Markets, an independent industry research firm, the global geospatial analytics market is projected to grow from about $33.0 billion in 2024 to about $55.8 billion by 2029, resulting in a compound annual growth rate of 11.1%. Of the Company’s customers, it is notable that the U.S. Space force has requested a budget of $30.0B, $19.2B of which is aimed at R&D, testing, and evaluation. The Company is also taking advantage of demand created by international government and organizations, as exemplified by the $150.0M, plus contract awarded by a major international ministry of defense, among others.

We believe BKSY is well positioned to capitalize on this demand as industry wide supply growth is slowing. We believe that legacy satellite imaging providers may not be able to provide the capacity needed to meet the growing

demand as their aging constellations are being replaced with lower capacity satellites. We believe the expansion of BKSY capacity will be met by strong demand and that BlackSky is well positioned to capture a significant share of the growth in the space data and analytics market.

Risks

As with any investment, there are certain risks associated with BKSY’s operations as well as with the surrounding economic and regulatory environments common to the research and consulting services industry.

Customer Concentration

BKSY is dependent on a small number of customers for a significant portion of its revenue. The U.S. federal government and its agencies, along with two other customers accounted for 60% and 62% of total revenue in FY24 and FY23, respectively. If the Company lost one or more of these customers, it would significantly impact earnings.

Computing Infrastructure Dependence

The Company relies on third party SaaS companies to host and maintain its proprietary imagery and analytics used to deliver to its customers. Currently, BKSY primarily uses Amazon Web Services, and any disruption from this service provider would potentially impact BKSY customers and could negatively impact BKSY.

Government Contract

BKSY has contracts with government entities. Government entities are subject to changing policies, priorities, regulations, mandates, and funding levels. Fluctuations in any of these variables could negatively impact the demand from government entities and impact the Company’s revenue.

Satellite Risks

BKSY operates a fleet of satellites that are very technically complex. Putting a satellite into orbit can be delayed during construction, delayed during launch due to permitting or launch windows closing, and is subject to launch failures. Any of these incidences would negatively impact revenue and could incur impairment charges. Additionally, satellites may fail to operate as intended and/or may not operate through the entire predicted life due to severe environmental stress. This would also adversely affect the Company’s profitability.

Competitive Industry

BKSY operates in a competitive industry with a number of players, some of which are larger than the Company. Should the Company fail to expand its customer base the business may suffer.

IMPORTANT DISCLOSURES AND DISCLAIMER

(a) The research analyst and/or a member of the analyst’s household do not have a financial interest in the debt or equity securities of the subject company.

(b) The research analyst responsible for the preparation of this report has not received compensation that is based upon Stonegate’s investment banking revenues.

(c) Stonegate or any affiliate have not managed or co-managed a public offering of securities for the subject company in the last twelve months, received investment banking compensation from the subject company in the last 12 months, nor expects or receive or intends or seek compensation for investment banking services from the subject company in the next three months.

(d) Stonegate’s equity affiliate, Stonegate Capital Partners, “SCP” has a contractual agreement with the subject company to provide research services, investor relations support, and investor outreach. SCP receives a monthly retainer for these non investment banking services.

(e) Stonegate or its affiliates do not beneficially own 1% or more of any class of common equity securities of the subject company.

(f) Stonegate does not make a market in the subject company.

(g) The research analyst has not received any compensation from the subject company in the previous 12 months.

(h) Stonegate, the research analyst, or associated person of Stonegate with the ability to influence the content of the research report knows or has reason to know of any material conflicts of interest at the time of publication or distribution of the research report.

(i) No employee of Stonegate has a position as an officer or director of the subject company.

Ratings – Stonegate does not provide ratings for the covered companies.

Distribution of Ratings – Stonegate does not provide ratings for covered companies.

Price Chart – Stonegate does not have, nor has previously had, a rating for its covered companies.

Price Targets – Stonegate does not provide price targets for its covered companies. However, Stonegate does

provide valuation analysis.

Regulation Analyst Certification:

I, Dave Storms, CFA, hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report.

For Additional Information Contact:

Stonegate Capital Partners, Inc.

Dave Storms, CFA

Dave@stonegateinc.com

214-987-4121

Please note that this report was originally prepared and issued by Stonegate for distribution to their market professional and institutional investor customers. Recipients who are not market professional or institutional investor customers of Stonegate should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. The information contained herein is based on sources which we believe to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. Because the objectives of individual clients may vary, this report is not to be construed as an offer or the solicitation of an offer to sell or buy the securities herein mentioned. This report is the independent work of Stonegate Capital Partners and is not to be construed as having been issued by, or in any way endorsed or guaranteed by, any issuing companies of the securities mentioned herein. The firm and/or its employees and/or its individual shareholders and/or members of their families and/or its managed funds may have positions or warrants in the securities mentioned and, before or after your receipt of this report, may make or recommend purchases and/or sales for their own accounts or for the accounts of other customers of the firm from time to time in the open market or otherwise. While we endeavor to update the information contained herein on a reasonable basis, there may be regulatory, compliance, or other reasons that prevent us from doing so. The opinions or information expressed are believed to be accurate as of the date of this report; no subsequent publication or distribution of this report shall mean or imply that any such opinions or information remains current at any time after the date of this report. All opinions are subject to change without notice, and we do not undertake to advise you of any such changes. Reproduction or redistribution of this report without the expressed written consent of Stonegate Capital Partners is prohibited.

Additional information on any securities mentioned is available on request.