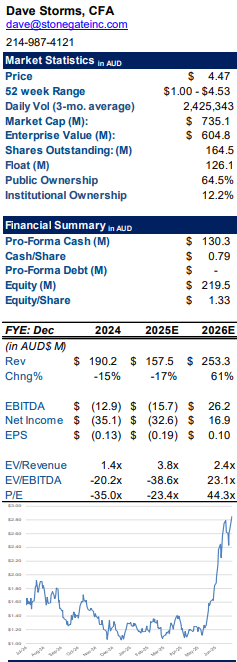

Electro Optic Systems Holdings Limited is a global aerospace & defense and communications company with operations in Australia, United States, Middle East, Asia, and Europe. EOS develops, manufactures, and sells remote weapons systems, counter-drone weapons systems, naval satellite communication systems and space domain awareness services. The Company operates across two segments: Defense Systems and Space Systems. EOS is currently headquartered in Canberra, Australia with regional offices in the United States, the United Arab Emirates, Singapore, the Netherlands, and Germany.

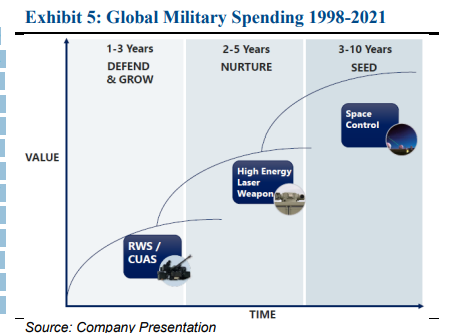

COMPANY UPDATES Significant HELW Contract: In August of 2025 EOS announced that it has secured an order for a 100kW high power laser weapon system (HELW) for counter-drone warfare. This is a A$125.0M contract for a HELW that is to be delivered to a European NATO member, with revenues expected to be recognized over the next 3 years. Of note, this unit can take down 20 drones per minute, which is approximate 5 to 10 times more efficient than current kinetic kill options and does not have the constraint of cool down time. We also note that this contract is expected to be accretive to margins and cash flow positive in the back half. Going forward we expect EOS to secure a further contract for a HELW in 2026. Given the short training window needed to operate these weapons, and significant need for cheaper and effective counter-drone weapons we expect this vertical to become a very significant growth driver as EOS has reason to believe it is poised to capture 50% of the HELW TAM given the proprietary technology and first mover advantage it has. Growth Outlook: The Company has laid out a three-pronged approach for accelerated growth over the medium term that is two parts internal and one part external. EOS expects to focus resources on counter drone RWS technology over the next 1 to 3 years and HELW technology over the next 2 to 5 years. With the above mentioned contract already signed, and another contract not far behind, we believe that this midterm growth potential will quickly come into focus. Aside from these HELW contracts the Company has seen significant order uptake among the other lines of its business. The Company continues to see growing market opportunities with or without a resolution to the war in Ukraine. Continued Diversification: EOS continues to diversify its product offerings as well as the geographies that it services. We note the strong demand for counter drone products is driven by the current market conditions discussed in further detail below. As the Company continues to grow its RWS offerings we expect the same market conditions to drive demand. EOS recently launched its R500 remote weapon system which is planned to come with AI-based target identification and tracking as well as mesh network capabilities. The Company is currently in the evaluation stage with an existing customer for a launch order of the R500 and has entered into a strategic collaboration to explore joint manufacturing of this system. We are additionally encouraged by management’s commentary around the current production capacity available over numerous geographies, giving enough flexibility to scale with incoming orders. Strong Backlog: As of the June trading update, the Company has a strong order backlog totaling AUD$170.0M, an increase from AUD$136.0M at year end. The majority of this backlog is expected to be monetized in 2025 and 2026. Most recently we note that the Company generated a positive operating cash flow of AUD$30.5m in 1Q25. Valuation: We use both a DCF Analysis and Comparable Analysis to inform our valuation of EOS. Our DCF analysis arrives at a valuation range of AUD$4.72 to AUD$5.39 with a midpoint of AUD$5.03. For the Comparable Analysis we arrive at a valuation range of AUD$4.77 to AUD$5.56 with a midpoint of AUD$5.17.

Business Overview

Electro Optic Systems Holdings Limited (“EOS,” “the Group”, or “the Company) is a global aerospace & defense and communications company with operations in Australia, United States, Middle East, Asia, and Europe. EOS develops, manufactures, and sells remote weapons systems, counter-drone weapons systems, naval satellite communication systems and space domain awareness services. The company is also developing further products, including high energy laser weapons. The Company operates across two segments: Defense Systems and Space Systems. EOS is currently headquartered in Canberra, Australia with regional offices in the United States, the United Arab Emirates, Singapore, the Netherlands, and Germany. The Company was originally founded in 1983 from the privatization of Australia’s government space activity. In the late 1990’s and early 2000’s, EOS began expanding globally and now serves markets in Australia, the United States, Europe, the Middle East and Southeast Asia. To date, the Company’s flagship product (the RWS 400) is well established and has sold over 2,500 units over fifteen years, working with more than ten different nations. The Group has grown to become the largest defense exporter in the Southern Hemisphere, with exports accounting for ~90% of revenue. In 2000 the group was officially listed on the Australian Securities Exchange under the symbol “EOS.”

Business Segments

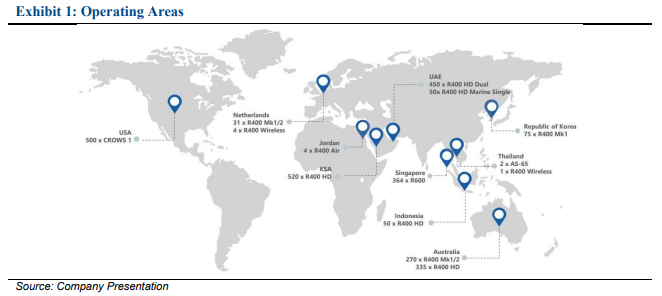

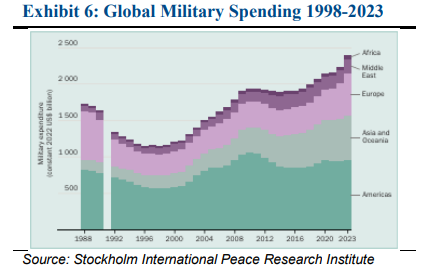

Electro Optics operates in two core segments: Defense Systems and Space Systems. The Company’s revenues are significantly dependent on governments ramping up their defense budgets, which could lead to major defense and space contract wins for EOS. Over the last two decades, countries have been steadily increasing their defense budgets to bolster their military strength and national security. Countries like the U.S. have started to increase investments in their remote weapon systems and unmanned vehicles capabilities, two core areas of EOS’s Defense business. For instance, counter-drone technologies are increasingly in demand and recent conflicts have demonstrated that traditional kinetic weapons have advantages as a cost-effective and sustainable counter-drone measure.

EOS Defense Systems

The EOS Defense Systems segment develops remote weapons systems (“RWS”) and weapon systems for unmanned ground vehicles (“UGVs”) as well as counter-drone applications. This segment accounts for AUD$100-200 million of the Company’s revenue. EOS is intent on capitalizing on future commercial growth by maximizing prospects provided by third-party development funding and making commercialization a core focus in the immediate future.

RWS production is responsible for the Company’s largest contract, which is supplying the UAE with 200 units worth USD$300 million into 2024. EOS has secured two conditional contracts totaling AUD$181 million to supply Ukraine with RWS. EOS has also won a few smaller contracts in Ukraine, involving the L3Harris VAMPIRE program, with additional wins in Southeast Asia and NATO.

The Company sees its counter-drone applications as an opportunity for outsized growth. In 2023, EOS launched its newest counter-drone product named “Slinger.” The Slinger product was launched in May 2023 and was available for both the domestic Australian market as well as international markets to address current and emerging threats that are informed by the Ukraine conflict. The product is equipped with a radar and 30mm cannon that incorporates specialized ammunition with EOS’ proprietary technology for effective counter-drone operations. Next in line is the Company’s R500 remote weapon system.

UGVs are also a major growth area for EOS. Recent technological advancements have increased UGVs’ accuracy and reliability, making them attractive to customers. Over the last two decades, militaries have shifted their battlefield tactics by using drones and UGVs. The use of UGVs has become a top priority for international defense programs wishing to reduce casualties while increasing lethality. EOS provides remote lethality to the U.S., Thailand, the Netherlands, and Australia.

Additionally, EOS is growing the pipeline for its directed energy weapon, a high-energy laser weapon (HELW), that management expects to bring growth potential. It functions somewhat comparably to the laser from James Bond’s Goldfinger. The Company announced in 1H25 the first contract for the sale of a HELW unit for a price of A$125.0M. This new technology could provide a catalyst to significantly drive revenues as the price per shot of HELW weapons could be a tenth of the price per shot for current anti-drone kinetic options. The Company is now in the advanced stages of negotiations for this product with an estimated opportunity size in the range of $100M to $200M. Further research and development into this technology is expected following EOS securing a launch customer for this new technology.

EOS Space Systems

EOS’s Space Segment is an industry leader that specializes in space surveillance and intelligence services, space control and warfare capabilities, and optical and satellite communications products. In the space, this segment has produced inconsistent and unreliable results for EOS. However, management has a commitment to only invest in activities that have true potential to produce meaningful returns in the future. By focusing its efforts on bolstering its operating efficiency to build superior products, EOS can capitalize on a rapidly growing market with governments actively working to build their space capabilities.

In March 2023, the White House proposed a USD$30 billion budget for the U.S. Space Force, increasing by USD$4 billion over 2022. This exhibits the U.S. commitment to build up and maintain the Space Force in the face of impending threats from China and Russia. As other countries follow suit and build their space warfare capacities, EOS could be presented as a significant opportunity to garner extensive contract wins. Most recently the Company secured a AUD$9.0m contract with the Australian Defense Force Joint Capabilities Division to further develop its space capabilities with expected delivery in FY25.

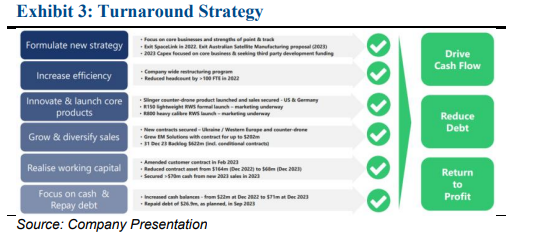

Turnaround Strategy

EOS has implemented a turnaround strategy to scale the company’s revenue and reach profitability. This began with the appointments of new CEO Andreas Schwer, CFO Clive Cuthell, and Chair Garry Hounsell. Historically, the Company was known to severely overpromise on their expectations only to completely underdeliver, losing credibility and investor trust in the process. New management adopted an opposite approach by giving honest expectations and clearly displaying their goals by initiating a multiphase turnaround program.

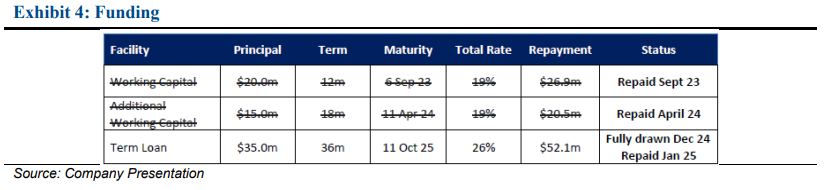

The now completed phase 1 concentrated on restructuring the business. When EOS’s new management was appointed, its immediate goals were to cut unnecessary costs and seek additional funding, seen by the termination of the cash burning SpaceLink venture and the borrowing facilities set up in October 2022. This was swift and effective as EOS has ended AUD$26m per year of cash outflows from SpaceLink and AUD$25m from roles that were redundant. The Company also fully drew its AUD$70m principal loan to push operations forward.

Phase 2 is currently underway and is focused on collecting cash from customers and securing new orders. Thus far, the Company has made true on the plan, by renegotiating contracts and building up a backlog. In the short term, cashflows were strong in 2024 as the Company focused on cash generation. However, the Company is now in a solid position to drive its cash performance in 2025. If EOS sticks to its turnaround strategy, its reputation should improve, allowing the business to grow.

With EOS at the midway point of its turnaround program, we expect the Company to continue focusing on cash receipts as well as management of cost and capital. While this is an ongoing process, we also expect the company to begin moving its focus towards growing strategic partnerships as part of the next phase of the turnaround. We see steps being taken towards this phase with the announcement of the European entity that will grow the Company’s footprint in Europe.

Ability to collaborate with customers in the region as well as the Company’s 1H25 divestiture of its EM Solutions segment.

Financing and Growth Strategy

In the fall of 2022, EOS set up borrowing facilities with equity investor Washington H. Soul Pattinson (“WHSP”), containing terms that interest can be capitalized in 12 months. The Company received AUD$70 million principal, and the total amount required to be repaid was AUD$127m. On July 30, 2023, the facilities were fully drawn, despite having AUD$42.0m in cash to continue funding operations. Due to the challenging circumstances the Company was facing when they took this loan, leading to the high rates seen in exhibit 4. In 1H25, EOS repaid this debt following the divestiture of its EM Solutions segment. This divestiture automatically triggered the repayment along with its associated early payment penalty. Following the divestiture and subsequent debt repayment, EOS emerged in a strong financial position with substantial cash for its growth initiatives.

Going forward, we expect EOS to take a three-pronged approach to its growth strategy that is two parts research and development and one part external growth.

The first two prongs of internal growth are expected to focus on its RWS technology in the short term and HELW technology in the medium term. Following this, we expect the Company to focus more intently on space control as pilot phases and prototyping are completed. Through this, we expect EOS to use its strong financial position to add bolt-on acquisitions that will help fill capability gaps and/or de-risk the Company’s supply chain.

Market Overview

Global military spending has steadily increased over the last three decades. Despite a high inflationary environment, governments have actively increased their military budgets, largely due to the war in Ukraine as well as rising tensions in Asia. In fact, global military spending reached an all-time high in 2023, surpassing USD$2 trillion, and this number is increasing. Ukraine’s military spending was USD$64.8 billion in 2023, increasing ~47% over 2022. With the War in Ukraine and tensions in Asia and the Middle East showing no sign of resolving soon, this rapid growth in spending is expected to persist.

EOS has experienced the effects of the spending surge with active contracts and contract negotiations to supply Ukraine and supporting countries with RWSs. In January 2023, the defense systems secured a contract in the U.S. for use in the L3Harris Vampire program supporting Ukraine. In April 2023, the Company entered conditional contracts with Ukraine valued at AUD$181m to supply RWS, including ammunition, spares, and related services. Consistent contract wins like this are key for the Company’s future, especially as defense spending continues to reach all-time highs.

Risks

As with any investment, there are certain risks associated with EOS’s operations as well as with the surrounding economic and regulatory environments common to the Aerospace & Defense industry and operating in foreign countries.

- Highly Competitive Industry: The Aerospace & Defense industry is highly competitive with several large players. Should EOS fail to attract more customers or lose current customers to other companies, the business could suffer. Additionally, should countries begin to reduce their budgets and reduce their demand for defense solutions, competition will rise, and EOS’s market will decrease.

- Geopolitical Change: EOS operates in an industry that is subject to high geopolitical risk. Should governments reduce their military budgets, EOS becomes more at risk of a reduction in its revenues. Additionally, some of the markets that the Company operates in are exposed to political and economic instability, which could bring negative pressures on operations.

- Customer Concentration: The Company’s activities are currently concentrated with two customers in two markets with a backlog of over AUD$300m. A delay in cash receipts puts downward pressure on the business. Failure to secure future sales contracts and diversify its customer base could hurt the Company’s ability to continue operations.

- Regulatory Changes: The Company is exposed to regulatory changes. The risks of regulations include export licenses, security obligations, and compliance with countries’ securities legislation. This subjects EOS to potential legal disputes, investigations, and sanctions from investors, governments, and customers, amongst others. Any sort of legal action taken on the Company could have negative ramifications on operations.

VALUATION SUMMARY

We use a DCF Analysis and a Comparison Analysis to frame valuation

DCF Analysis

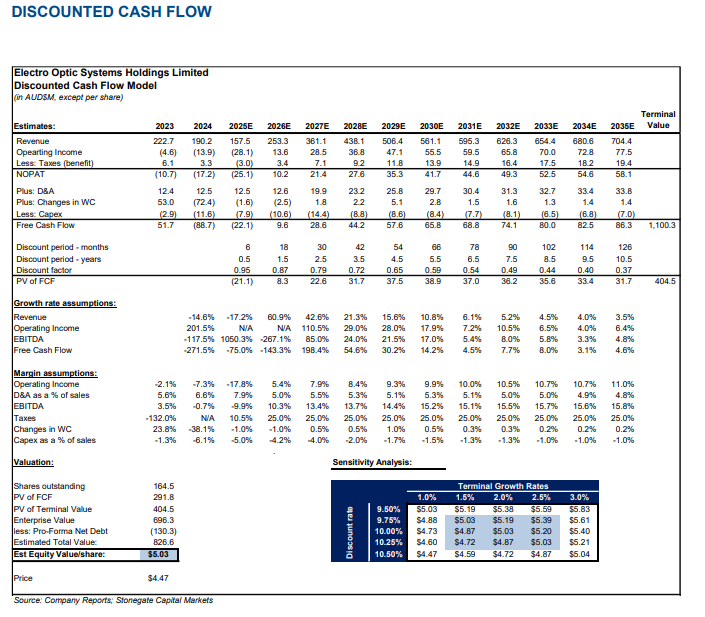

We are modeling near-term revenue growth rates driven by continued contract wins around the globe.

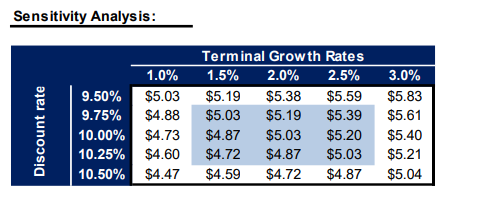

Our longer-term revenue growth normalizes around 5%. For our sensitivity analysis, we used a range of discount rates from 9.75% to 10.25% and terminal growth rates between 1.50% and 2.50%. We selected this discount rate to account for EOS’s smaller market cap and the current interest rate environment. This results in a valuation range of AUD$4.72 to AUD$5.39 with a midpoint of AUD$5.03.

VALUATION SUMMARY

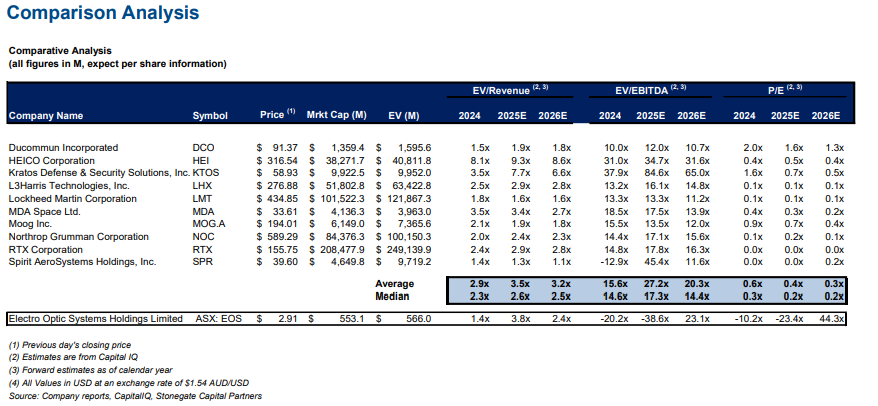

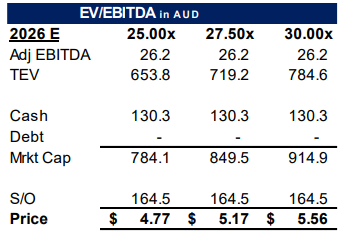

We use an EV/EBITDA multiples comparison to determine a valuation range for EOS. Given the current turnaround story, large backlog of receivables, and recent contract wins coupled with the potential for continued growth due to the favorable market outlook, we feel comfortable using FY26 estimated EBITDA to value EOS. This allows us to value EOS as compared to the above peer companies that are trading at an average of 20.3x of estimated EV/EBITDA in 2026. This is compared to EOS that is trading at 23.1x, based on our estimates.

We believe that EOS should be trading at a 2026 EV/EBITDA range of 25.0x to 30.0x, which will bring the Company in line with growth-oriented peers and applies a well-deserved premium over legacy peers such as LHX, LMT, and NOC. This informs a valuation range of AUD$4.77 to AUD$5.56 with a midpoint of AUD$5.17.

IMPORTANT DISCLOSURES AND DISCLAIMER

(a) The research analyst and/or a member of the analyst’s household do not have a financial interest in the debt or equity securities of the subject company.

(b) The research analyst responsible for the preparation of this report has not received compensation that is based upon Stonegate’s investment banking revenues.

(c) Stonegate or any affiliate have not managed or co-managed a public offering of securities for the subject company in the last twelve months, received investment banking compensation from the subject company in the last 12 months, nor expects or receives or intends or seeks compensation for investment banking services from the subject company in the next three months.

(d) Stonegate’s equity affiliate, Stonegate Capital Partners, “SCP” has a contractual agreement with the subject company to provide research services, investor relations support, and investor outreach. SCP receives a monthly retainer for these non-investment banking services.

(e) Stonegate or its affiliates do not beneficially own 1% or more of any class of common equity securities of the subject company.

(f) Stonegate does not make a market in the subject company.

(g) The research analyst has not received any compensation from the subject company in the previous 12 months.

(h) Stonegate, the research analyst, or associated person of Stonegate with the ability to influence the content of the research report knows or has reason to know of any material conflicts of interest at the time of publication or distribution of the research report.

(i) No employee of Stonegate has a position as an officer or director of the subject company.

Ratings – Stonegate does not provide ratings for the covered companies.

Distribution of Ratings – Stonegate does not provide ratings for covered companies.

Price Chart – Stonegate does not have, nor has previously had, a rating for its covered companies.

Price Targets – Stonegate does not provide price targets for its covered companies. However, Stonegate does provide valuation analysis.

Regulation Analyst Certification:

I, Dave Storms, CFA, hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report.

For Additional Information Contact:

Stonegate Capital Partners, Inc.

Dave Storms, CFA

Dave@stonegateinc.com

214-987-4121

Please note that this report was originally prepared and issued by Stonegate for distribution to their market professional and institutional investor customers. Recipients who are not market professional or institutional investor customers of Stonegate should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. The information contained herein is based on sources which we believe to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. Because the objectives of individual clients may vary, this report is not to be construed as an offer or the solicitation of an offer to sell or buy the securities herein mentioned. This report is the independent work of Stonegate Capital Partners and is not to be construed as having been issued by, or in any way endorsed or guaranteed by, any issuing companies of the securities mentioned herein. The firm and/or its employees and/or its individual shareholders and/or members of their families and/or its managed funds may have positions or warrants in the securities mentioned and, before or after your receipt of this report, may make or recommend purchases and/or sales for their own accounts or for the accounts of other customers of the firm from time to time in the open market or otherwise. While we endeavor to update the information contained herein on a reasonable basis, there may be regulatory, compliance, or other reasons that prevent us from doing so. The opinions or information expressed are believed to be accurate as of the date of this report; no subsequent publication or distribution of this report shall mean or imply that any such opinions or information remains current at any time after the date of this report. All opinions are subject to change without notice, and we do not undertake to advise you of any such changes. Reproduction or redistribution of this report without the expressed written consent of Stonegate Capital Partners is prohibited. Additional information on any securities mentioned is available on request.